Crash-testing Japan's New Capitalism

Global macro-cycle inflection -- America's cyclical downturn is poised to force the next round of Japan's economic restructuring

By popular request, here a couple of thoughts on Yen capital markets and the Japan outlook after last week’s surge in the Yen and the crash in the Tokyo stock market:

The severity of Japan’s market moves last week serves as a brutal reminder that, in the the short-term, global cyclical conditions and currency gyrations remain the most important driver for Japan’s capital markets. Yes, for every Y10 of Yen appreciation, corporate profits fall by approximately 8% and consumer price inflation falls by approximately 0.4% (1). Bad deflation for profits; good deflation for consumers.

So if, as I suspect, the global macro cycle has started to reverse, U.S.$ appreciation is a thing of the past. From here, Y115-120/$ has become a reasonable target, likely to be reached over then next 6-12 months. For Japan this means corporate earnings expectations are now too high by around 15-20%, while at the same time forecasts for a Japan consumer-led recovery are too low.

Yes, I remain unashamedly optimistic on the longer-term outlook for superior returns from Japanese risk assets — equities & real estate; but the accelerating cyclical downturn in America will force an inevitable break in Japan’s capital markets upturn, will likely overpower local and global investor enthusiasm for steadfast progress on domestic industrial restructuring and return-on-capital enhancing strategies. The Japan Optimist is patient and in it for the long run. This new global “risk off” cycle will pass, but not before crash-testing the optimistic Japan thesis. In fact, this domestic asset market “crash test” will turn into the next catalyst for accelerated transformation in Japan.

Clear speak:

in global financial markets, all starts and ends with America: as US recession risks rise, the U.S.$ up-cycle comes to end. Don’t fight it. Warren Buffet has just raised his cash holdings to an all-time high - he expects to be able to buy cheaper in the future. Japan investors will follow his lead.

the U.S. policy response to rising recession risks will be lopsided, dominated by U.S. rate cuts — Washington’s fiscal policy response will inevitably be “too little, too late”. This is not just because of the immediate practicalities dictated by the election cycle. Even post-election, the realities of entrenched political polarization make a U.S. government shutdown more likely than bipartisan pro-growth action. More fundamentally, U.S. budget constraints are real : whoever leads the U.S. next year will face close to zero discretionary fiscal flexibility as the budget is increasingly dominated by runaway interest expense, military spending, and entitlements impossible to cut without losing votes. Any fiscal action - particularly cutting taxes without cutting spending - is poised to add fuel to what has always been the solution to runaway fiscal deficits: inflation.

—> Fed ate cuts are the only credible policy tool, so as U.S. hard-landing risks rise, so does the likelihood of rate cuts being more aggressive than currently expected

—> the U.S. yield curve is poised to end its two-year long inversion and steepen (meaning Japan-based investors will once again be paid to hedge U.S. assets portfolios, i.e. less outright demand for dollars).

in contrast, Japan’s recession risks are low: the up-cycle has not been export-led, but is led by an unprecedented pick-up in corporate metabolism - record capital investment, record M&A activity, record bankruptcies (meaning: long overdue death of “zombie companies”, a clear positive for productivity).

The driver here is first of all the growing structural scarcity of labor — unemployment is falling in Japan, not rising like in America.

More importantly: this structural scarcity of labor actually has freed Japan policy makers to re-commit to capitalism. After decades of unprecedented “financial socialism” and capital markets intervention to cushion against rising unemployment — the BoJ owns slightly more than half of all government debt, owns just about 10% of the TOPIX market capitalization, and, together with other government agencies, guarantees as much as half of of Japan’s private credit outstanding — policy makers are now committed to stimulate a re-allocation of resources by raising the cost of capital.

Governor Ueda’s “normalization” of monetary policy is all about putting a price on money and credit. Make no mistake: he can do so more confidently than any of his predecessors because he does not have to worry about a serious up-tick in unemployment. Yes, nobody knows for sure, but a normal & neutral” policy rate would most likely be around 1.75-2.25% (Taylor rule). A Yen appreciation cycle will not get in the way of Governor Ueda’s determination to get to “normal” by the time he starts the second half of his five-year tenure, ie. end-2025.

—> Ueda’s BoJ will continue to follow the normalization path and will probably get to the “neutral” policy rate of 1.75-2% faster than markets currently anticipate.

—> the Japan yield curve is poised to flatten as Yen appreciation keeps inflation expectations well in check

Importantly: Yen appreciation will lead to an improvement in consumers’ terms-of-trade (falling energy & food prices), thus boosting real household purchasing power. The likely result: after more than two years of stagnation, real consumer spending is poised to become a positive growth driver. Watch for next year’s “Shunto” to bring a nominal wage hike of at least as high as this year’s 5% - despite CPI inflation poised to be running lower because of Yen appreciation.

Japan corporate & industrial restructuring — the next catalyst

The three dominant forces of Japan’s economic restructuring are :

structural labor shortage forcing —> rising labor input costs

the stock exchange holding member companies accountable to proper capital returns —> a higher cost of equity

the BoJ’s commitment to debt capital market ‘privatization’ and putting a market determined price on money & credit —> a higher cost of debt capital

Against this, there have been two major “cushions” softening pressure to restructure :

fiscal policy, with Prime Minister Kishida having extended “zombie” company loan guarantees and sub-market rate lending support, as well as a multitude of special policy measures designed to cushion small&medium sized enterprises against rising input costs, including, for example, offering tax incentives for companies raising wages

Yen depreciation, with every y10 of Yen depreciation adding approximately 8% to listed companies profits — obviously the primary beneficiary here is large exporters, while importers’ suffer a margin squeeze. Inevitably, terms-of-trade effects produce winners and losers. However, the reality of exporters’ windfall gains does create a “cushion” for the domestic suppliers to the large exporters - windfall profits at the top of the food chain do allow for more generous supplier price point negotiations lower down.

If I am right and the global U.S.$ appreciation cycle is over, Yen appreciation will now become the catalyst for the next round of industrial restructuring. A particular focus here is Japan’s exporters, with downward pressure on earnings poised to deliver more aggressive and focused restructuring strategies. I expect a next wave of M&A, particularly in the machinery- and machine tool industries, as well as in the transportation sector.

Of course, fiscal policy is poised to be mobilized once again to help cushion against Yen appreciation forcing the next wave of capitalism coming to Japan. The probability of another large-scale supplementary budget being proposed by Prime Minister Kishida in the next couple of months is rising….

Be this as it may. Here some charts and data that highlight some of the key dynamics to watch out for when forecasting the Yen:

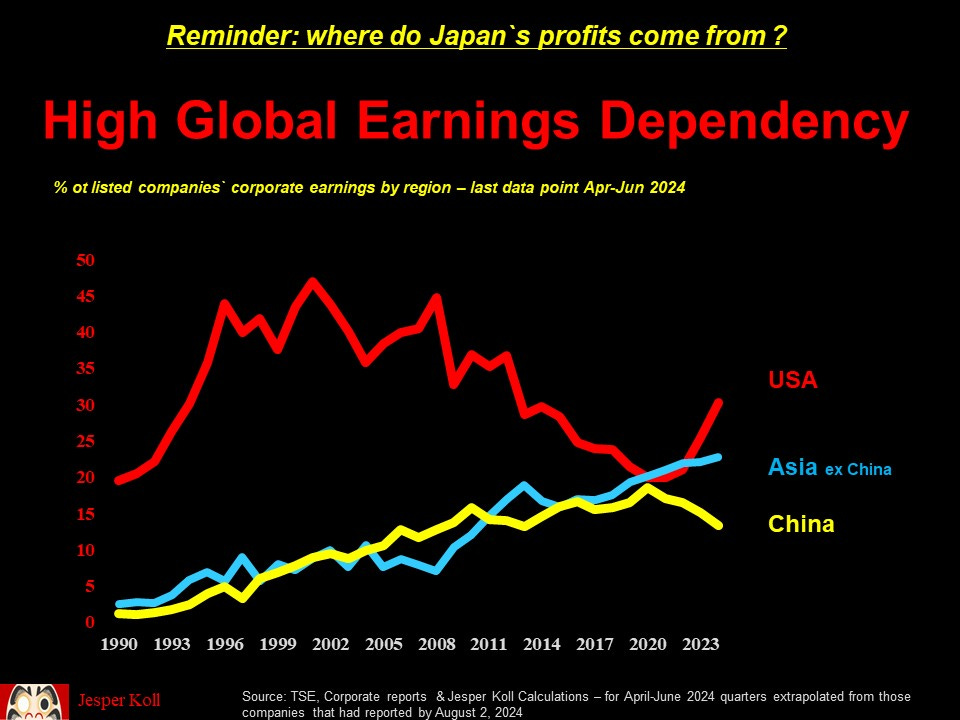

Highly dependent on global growth, U.S. growth in particular

Approximately two-thirds of listed companies earnings come from either exports or global production / sales. By region, dependency on the U.S. has re-accelerated in recent years because of both strong U.S. growth as well as U.S. appreciation.

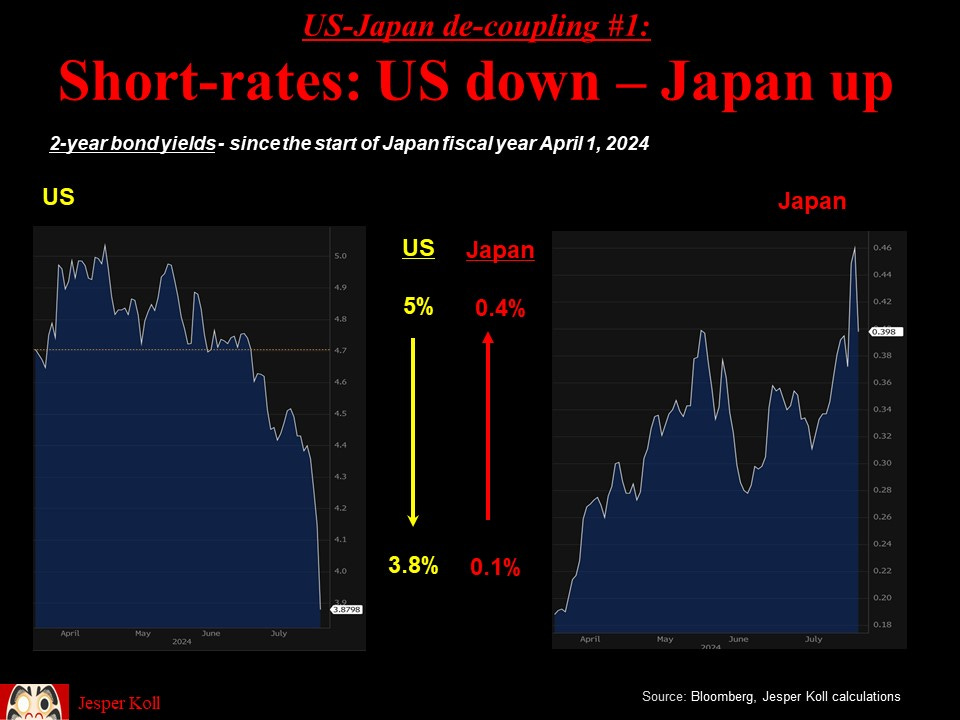

Why is the Yen surging? Simple does it: U.S. rates are falling, Japan rates are rising a little

There is no mystery behind the Yen’s appreciation, the U.S. depreciation: U.S. short-term rates have fallen a powerful 120 basis point from their end-April peak (from 5% to 3.8% for a 2-year bond). And U.S. long term rates have also dropped by 90 basis points (from 4.7% to 3.8%).

Yes, Japan rates have risen — the 2-year JGB yield is up 30 basis points to 0.4% since April; the 10-year JGB yield is up 20 basis points (to 0.9%).

The magnitude of rate changes says it all: it is U.S. rates that forced Yen appreciation, much more so than Governor Ueda’s moves. Still, the overarching narrative is that U.S.—Japan interest rate cycles remain de-coupled, but now in reverse: for the past years, U.S. rates went up but Japan’s stayed flat; now U.S. rates go down while Japan’s go up.

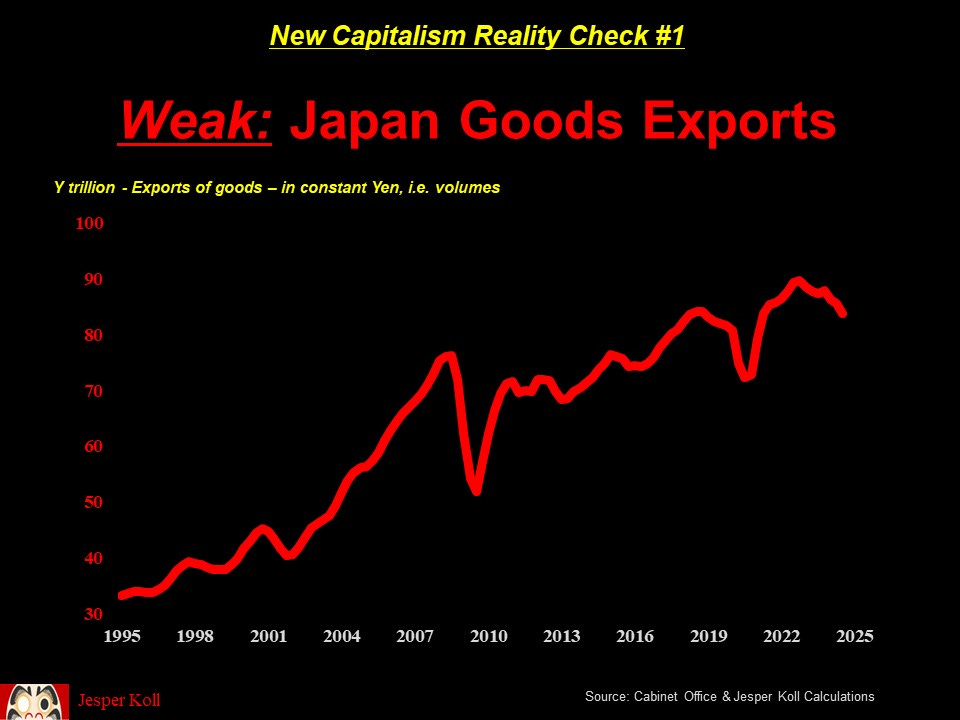

Structural worry: the weak Yen did boost profits - but not exports

While the weak Yen did boost exporters’ profitability, Japan’s actual export performance has been shockingly weak: goods export volumes have actually declined over the past couple of years. This is likely to be forced by the combination of three forces:

Made-in-China competition is now technologically advanced enough to offer perfectly fine substitution for Made-in-Japan product — the era of Made-in-Japan dominant machinery & machine tools has come to an end (passenger cars are a similar story, but the marginal change is much more worrying in the capital good sector).

U.S. global industrial- and economic security policy priorities have shifted, making it more difficult for Japan capital goods suppliers to sell to China (as well as the drop-off in Japan’s direct investment in China forcing a corresponding drop-off in naturally captive demand for made-in-japan suppliers).

U.S. domestic industrial- and economic security policy has tightened local-content rules, making it more difficult for non-U.S. based machinery- and machine tool companies to supply to the —booming— new factories being build in the U.S.

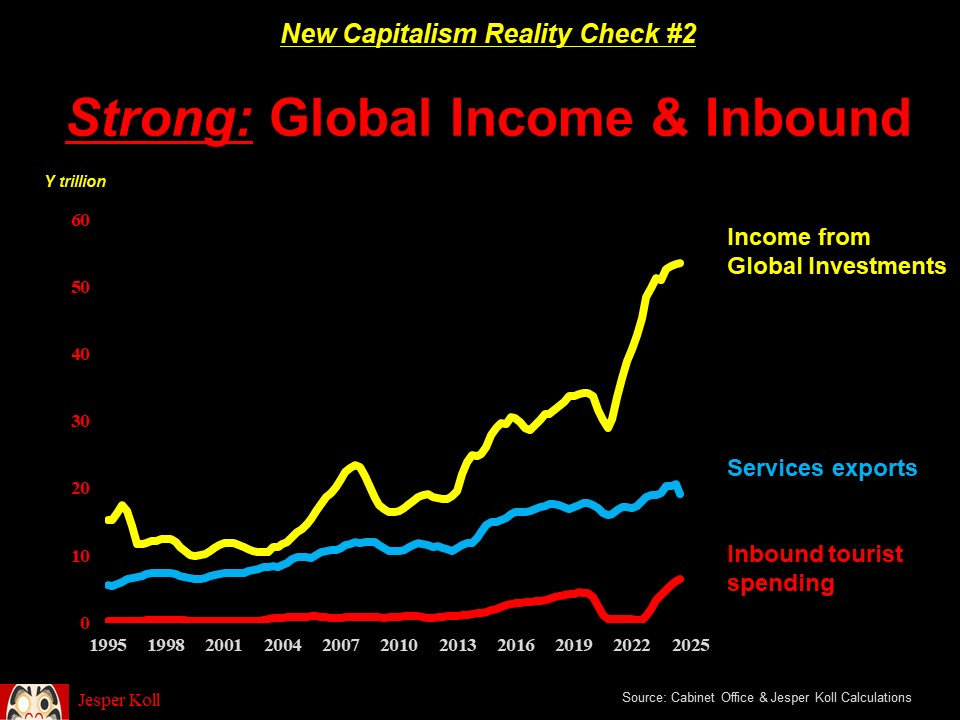

Structural shift: Surging global asset income & inbound tourism

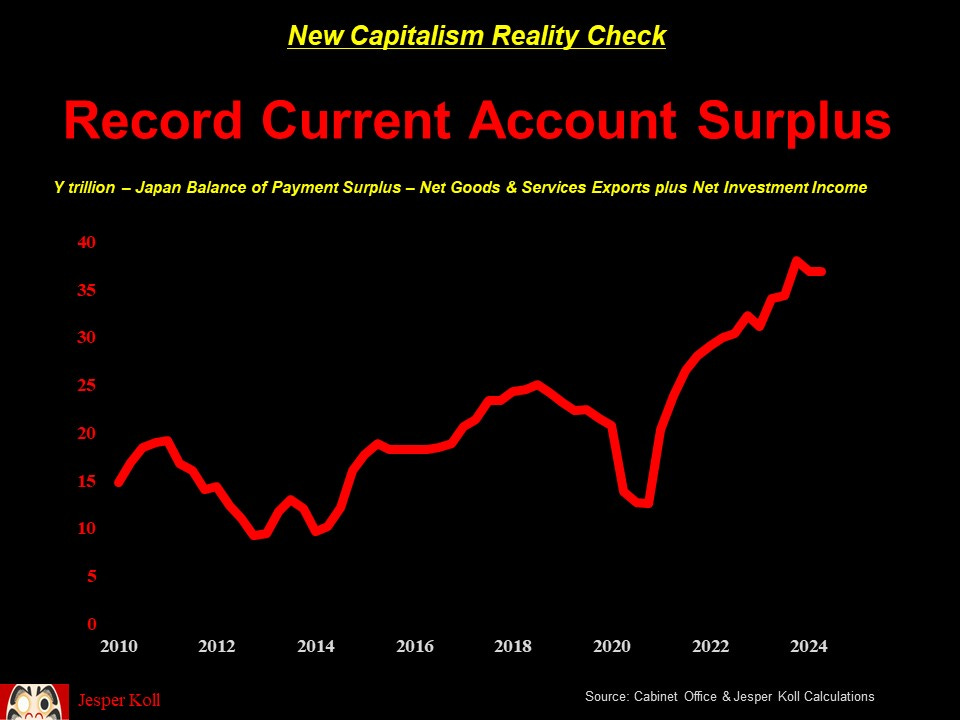

In contrast to weak exports of goods, Japan’s income from global assets has been surging. This is due to the combination of rising U.S. interest rates as well as the strong U.S. dollar turbo-charging interest income when translated into Yen. Also, inbound tourism — a made-in-Japan export — has surged to above pre-COVID levels.

From here, income from global investments is poised to decline, which in turn will start to put downward pressure on Japan’s current account surplus. For now, however, that fact that Japan’s current account surplus has been surging to new historic highs is another factor supporting a call for Yen appreciation — although interest rate differentials and relative yield-curve slopes are the dominant force now pointing towards a reversal of fortunes: Y115-120/$ is a reasonable target to expect over the next 6-12 months.

Thank you for reading. As always, comments welcome.

Many cheers from a hot & steamy Tokyo. ;-j

(1) technically, these sensitivities are valid not for short-term moves, but only when the currency move is sustained for at least 4-6 months (while global growth is assumed constant, i.e. these estimates are conservative because typically U.S.$ depreciation is in synch with a U.S. growth deterioration, which puts further downward pressure on Japan’s earnings).

My brain just crash -tested attempting to grasp all you had to say…but as always the nuances of your optimism shine bright.