Japan Reality Check #4: In praise of the Salaryman CEO

Profits up 11-fold on zero sales growth - Japan's Salaryman CEOs are hidden Superstars

Japan’s corporate leaders are much better than their reputation. Yes, they do lack the Davos-Jet-Set swagger, fly commercial, and still proudly print the office fax number on their meishi name-cards; and no, they have no social media presence and prefer to stay silent in investor- or press meetings. But if you’re looking for extraordinary resilience and all-around competence to get the job done, Japan’s Salaryman CEOs - and their teams - deliver. And yes, by “job” I mean a razor-sharp focus on delivering corporate economic value and profitability.

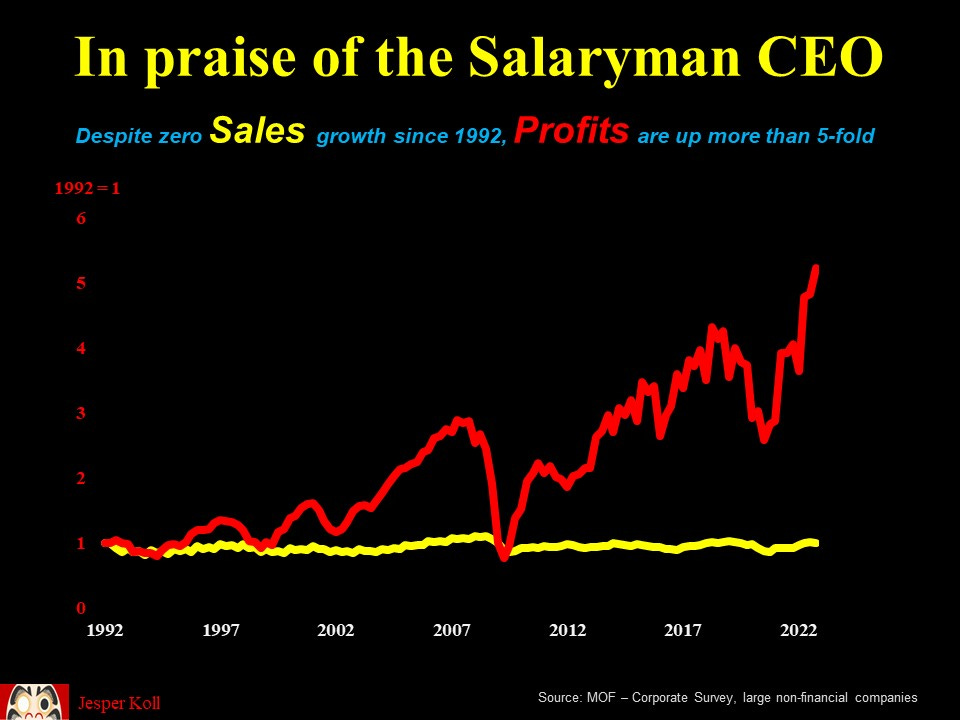

Don’t believe me? The data speaks for itself: since 1992, top-line growth for economy-wide non-financial corporate Japan has been flat. Yet despite this three-decade-long stagnation of sales, corporate profits surged more than 5-fold.

Anybody who has ever invested in or run a business knows how impossibly difficult it is to raise profits without the tailwinds of rising sales; for one year, maybe….but for thirty years? Japan’s Salaryman CEOs must have done something right…

Salaryman CEOs versus Superstars CEOs

In fact, the data also suggests Japanese Salaryman CEOs have absolutely nothing to be ashamed of in comparison to the Superstar CEOs of Wall Street.

For this cross-border comparison, I am now switching to data for companies listed on the big stock-exchanges, those in the TOPIX index for Japan and the S&P500 index for the U.S. : since 1995, Japan’s listed companies sales have also been basically flat, up 1.1-times; but profits are up a whopping 11-times. Against this, Wall Street Superstar CEOs delivered a 6-times increase in profits, with a tailwind of sales rising 3-times (all 1995 through 2022) (1).

Of course, the Superstar CEOs should be proud of delivering profits up 6-fold over the past 27 years; but compared to the 11-fold surge produced by Japan’s Salaryman CEOs the U.S. Superstar performance looks rather pedestrian….particularly since the Salaryman got no tailwind from rising sales.

Pay for performance

Importantly, the impressive performance of Japanese Salaryman CEOs has actually been reflected in their compensation: since 1990, CEO compensation for the top players has gone up just about 3-times. So for Japan Inc. profits are up 11-times but CEO compensation is up a more modest 3-times, but still up in sync with performance.

Meanwhile, in the U.S. the link between corporate performance and CEO compensation is much tighter: CEO compensation has mirrowed the rise in profits — both basically up 6-times since 1990.

Mind the gap : CEO pay to employee pay

The biggest difference between the Salaryman CEO and the Superstar CEO is, of course, the absolute gap in CEO compensation relative to average employee pay: in Japan this is now just about 50-times (for top 50 CEOs; the average is about 12-times, see (2).

On Wall Street, it’s a different dimension altogether: the average CEO now earns just below 400-times what his/her average employee earns in a year.

Put in another way: a Wall Street CEO earns in one day what his/her employees earn in a year; in Japan, for the 50 best-paid CEOs, it takes about one week; and for the average CEO it takes about one month.

Don’t get me wrong. This piece is not about whether U.S.-style or Japan-style corporate leadership is better. It is about highlighting some of the differences and most importantly, demonstrating that Japanese corporate leaders did in fact deliver what had been asked of them — focus on profits, profit, profits.

Why this tremendous achievement did not result in higher share prices will be the subject of a forthcoming article; it is easy to forget that true economic value creation is quite different from simple metrics like shareholder value or market capitalization.

But be this as it may. For now make no mistake: Japan’s Salaryman CEOs —and their executive teams — are much better than their reputation: more under appreciated achievers than lost generation. Although yes, it’s time to do away with that fax number…

As always, comments welcome. Thank you for reading & many cheers ;-j

(1) Profits here is EPS, Earnings per share, for both TOPIX and the S&P500

(2) my calculations are based on the top 50 CEOs, i.e. this result is biased to the very top performers and should not be taken as representative of the average in Japan, which is approximately 12x of average employee compensation.

While the focus on steadily increasing the bottom line over such a long period is to be commended, does the corresponding, relative lack of growth to the top line indicate an over-reliance on making incremental process improvements at the expense of new, somewhat risky investments to spur game-changing innovation? Maybe a more healthy balance of risk vs. reward should be the end goal.

What a clear and eye opening set of statistics and perspective. Thanks!