Japan Reality Check #5: Are start-ups and VC a good investment in Japan?

Outstanding returns attract entrepreneurs, investors...and policy makers

Japan is on track to becoming a Start-up Nation. Yes, the corporate culture is proud, abhors disruption, and stubbornly insists on prioritizing the serious business of fine-tuning rules-based processes rather than empowering a more playful innovation-for-innovation’s-sake mindset from its stakeholders. But no, Japan’s structural preference to prioritize resilience against shocks does not mean there is no premium paid for entrepreneurs obsessed with building something new and chasing dreams. Quite the opposite: Japan’s start-ups and venture capital have consistently outperformed global peers.

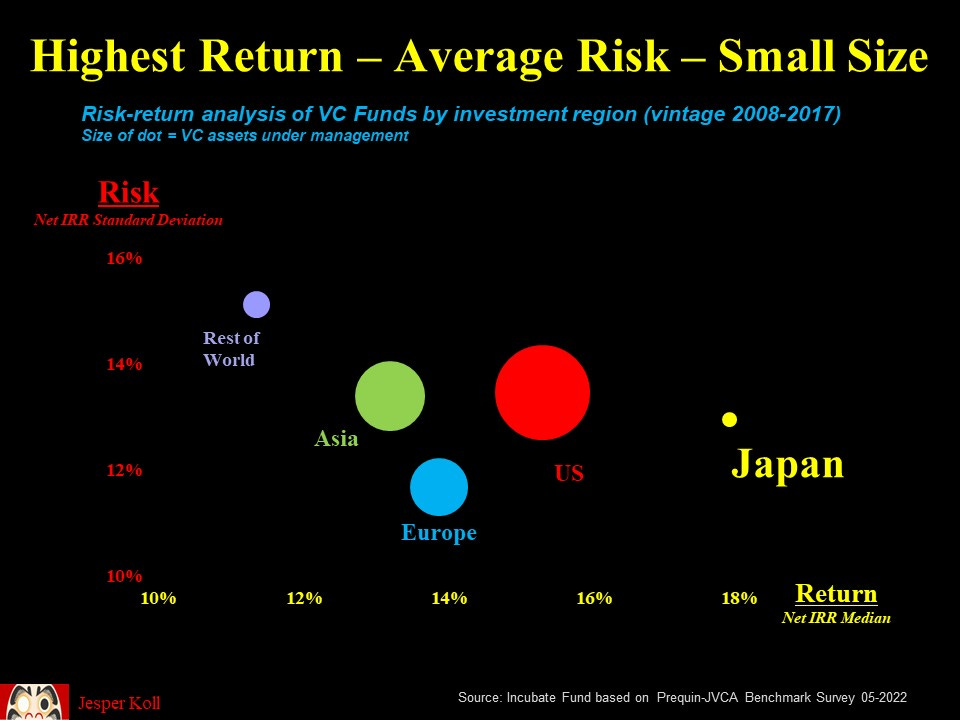

The data speaks for itself: in the decade before COVID, the net IRR (internal rate of return) for Japan VC funds was 18% per year, compared to 15% for US VCs, 14% for European ones, and 13% for Asia funds. And this was achieved with a similar risk profile - the net IRR standard deviation was basically similar across regions at around 13%.

So Japan venture capital has smartly outperformed global peers. Moreover, on the home front, comparison to Japan equities reveals a consistent outperformance of Japan VC funds of approximately 7% (over TOPIX) over the same decade.

Make no mistake: it is this high absolute and relative profitability that makes me confident Japan’s start-up and venture capital ecosystem will attract top talent and continue to grow. Capitalism works…

High profits attract both VC funds & entrepreneurs…

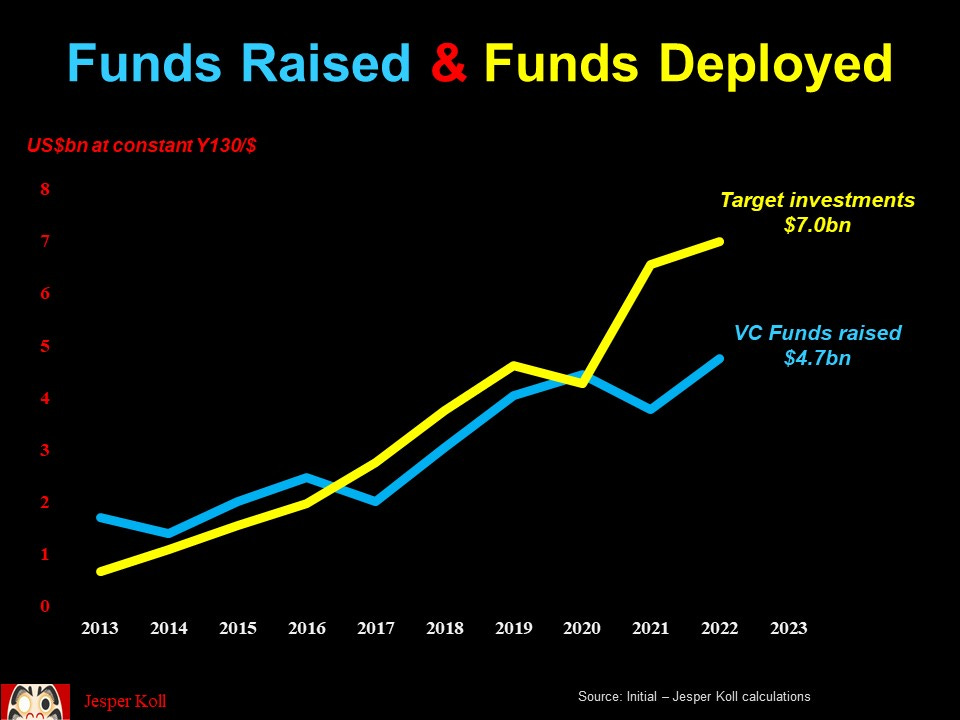

Growth in Japan’s start-up and venture capital ecosystem has been astounding: since 2013 the number of Japan-based VC funds has gone from 203 to 810, split approximately half-and-half between pure fiduciary VC funds and corporate VC arms. (this according to analytics provider INITIAL ; membership in the Japan Venture Capital Association has mirrored this rise, up five-fold to 250 members over the past decade, with the split between corporate VC and fiduciary VC also about 50-50).

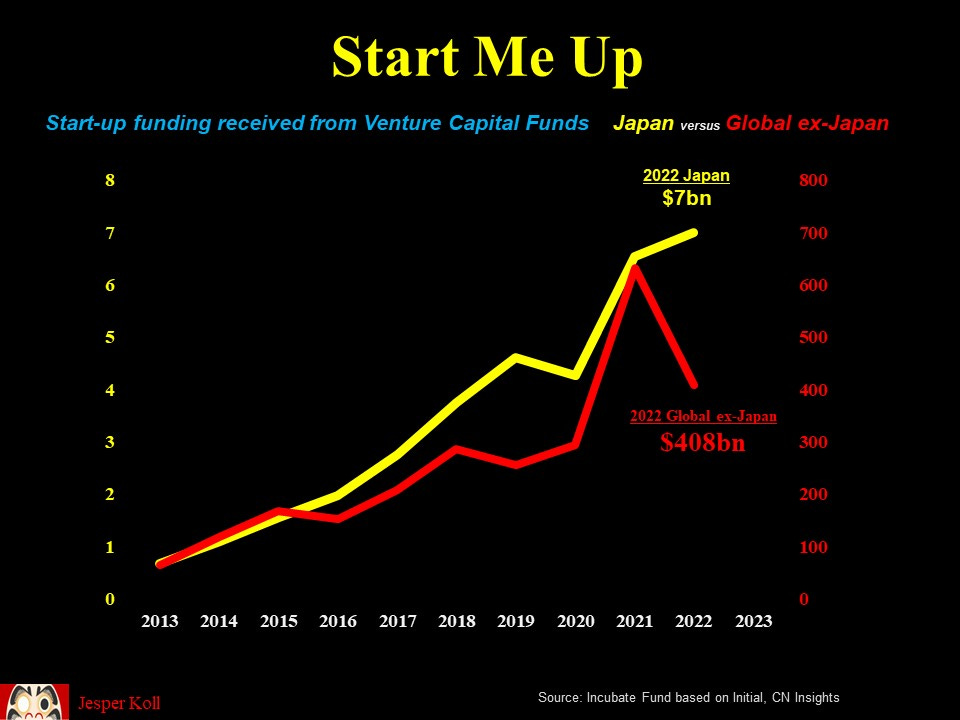

The result: VC-provided funding for start-ups has grown slightly more than 10-fold from less than Y90 billion to Y910 billion per annum (i.e. US$7 billion at Y130/$). This was made possible by a similar 10-fold increase in total AUM - assets under management - of Japan-based VCs, to around US$52 billion.

Interestingly, while outside Japan global VC funding started to drops-off sharply since the start of last year, Japan’s start-up ecosystem continued to grow.

…and policy makers

An important reason for the divergence between Japan VC and non-Japan VC comes down to the de-coupling of Japanese interest rates from US- and European ones (Japan target companies did not have to face the drop in the net present value of future cash flow forced onto US- and European ones by higher policy- and discount rates in the U.S. and Europe….). Make no mistake - the Bank of Japan staying put has continued to cushion Japan VCs against the harsher forces of financial gravity imposed across the Pacific.

In addition, Prime Minister Kishida has now fully committed to actively promoting both entrepreneurship, start-ups and a VC-centered innovation ecosystem. To achieve his goal of creating “100 Unicorns by 2027” a new wave of public-private VC partnerships is being set-up, while de-regulation and industry-guidance is also re-rigged. For example, banks are now encouraged to lend against growth prospects rather than against hard collateral and credit guarantees by founders.

Learning from Silicon Valley Bank

Here a deep study of the Silicon Valley Bank business model is highly recommended. It was actually a very innovative and sound banking business model. At its core, most of their pricing of credit risks to start-ups and founders relied on the empirical track record of the VC funds who commit to an equity funding round — its is easier to assign odds to an established VC fund stepping in to support a portfolio company they committed to in, say round A and round B, than it is trying to project the impossible, the future cash flow of a start-up. The unspoken benefit of a US-style VC culture is that if you have experts who’s livelihood depends on pricing the equity of a start-up enterprize, the bankers can much more easily begin to price credit risks.

And no, SVB did not blow up because of its start-up / VC credit pricing model. Lobbying for and receiving exemption from Federal Reserve stress-testing and risk management supervision is as much a root cause as is the frictionless deposit with-drawl systems now at the core of so much of US finance. In Japan, a “bank run at the speed of a tweet” is basically impossible given the frictions the domestic transfer systems.

Be this as it may. The primary point is that Japan’s establishment is now pro-actively embracing and incentivizing the development of a start-up and venture capital based domestic ecosystem. It will never be a copy of the US or Israel — remember, about half of the VC funds here are corporate venture capital. But still, it is “game-on” to turbo-charge Japan’s next-generation of entrepreneurs and innovators.

Small is beautiful…

To be sure: while the growth of funds raised and deployed in Start-up Nation Japan has been spectacular - driven by high returns - the absolute size of investments is still small: US total VC assets under management are estimate to be over US2.2 trillion, with even during last years bear market close to US$300 billion deployed to start-up targets. Against this, Japan total VC AUM is approximately US$52 billion, with US$7 billion invested in start-ups last year.

Average total target deal size came to US$23 million in the U.S., US$3.6 million in Japan last year.

Now, it is not really meaningless to compare absolute numbers across countries. Yes, America is bigger than Japan, thank you. How much? GDP is about 4.3-times bigger; corporate equity market capitalization about 7-times. Put into this context, the fact that the average deal size is about 6.4-times larger in America than in Japan does not look that weird; and the fact that the relative number of target companies — 6.5-times more in America — also suggesting that the actual gap in the economic impact of VC between Japan and America may not be that large.

From here, I have no doubt Japan’s VC and start-up ecosystem will continue to evolve at an accelerating rate. Nothing succeeds like success, and the reality of both the technocratic elite and the Prime Minister’s office now fully aligned on an industrial policy to support and foster Start-up Nation Japan is poised to keep momentum going.

The primary risk, in my view, could be the government doing too much: a key reason for why the venture capital model is successful is because it encourages failure. For every unicorn you get, say, 1,000 failures. the model works because it creates a market place where only the best survive. Japans capitalism is the worlds undisputed champion of protecting against failure. The good news is that the rapid growth in both fiduciary and corporate VCs should ensure against “zombie start-ups” becoming a hallmark of ‘new capitalism’.

Thank you for reading. From full-on Sakura Tokyo, many cheers ;-j

PS; Here is the link to Start-up Nation Japan, an open letter / article written to PM Kishida at the start of his reign, kindly published by the ACCJ at the time.

Another good article as usual. Since the heading of your article is "Are start-ups and VC a good investment in Japan" and your answer is clearly positive, you might may consider making some suggestions of VC's companies to invest in, or, if this is not possible for legal reasons or otherwise, provide a list of VC which are listed in Japan or point us in the right direction where the uninitiated can find such info.