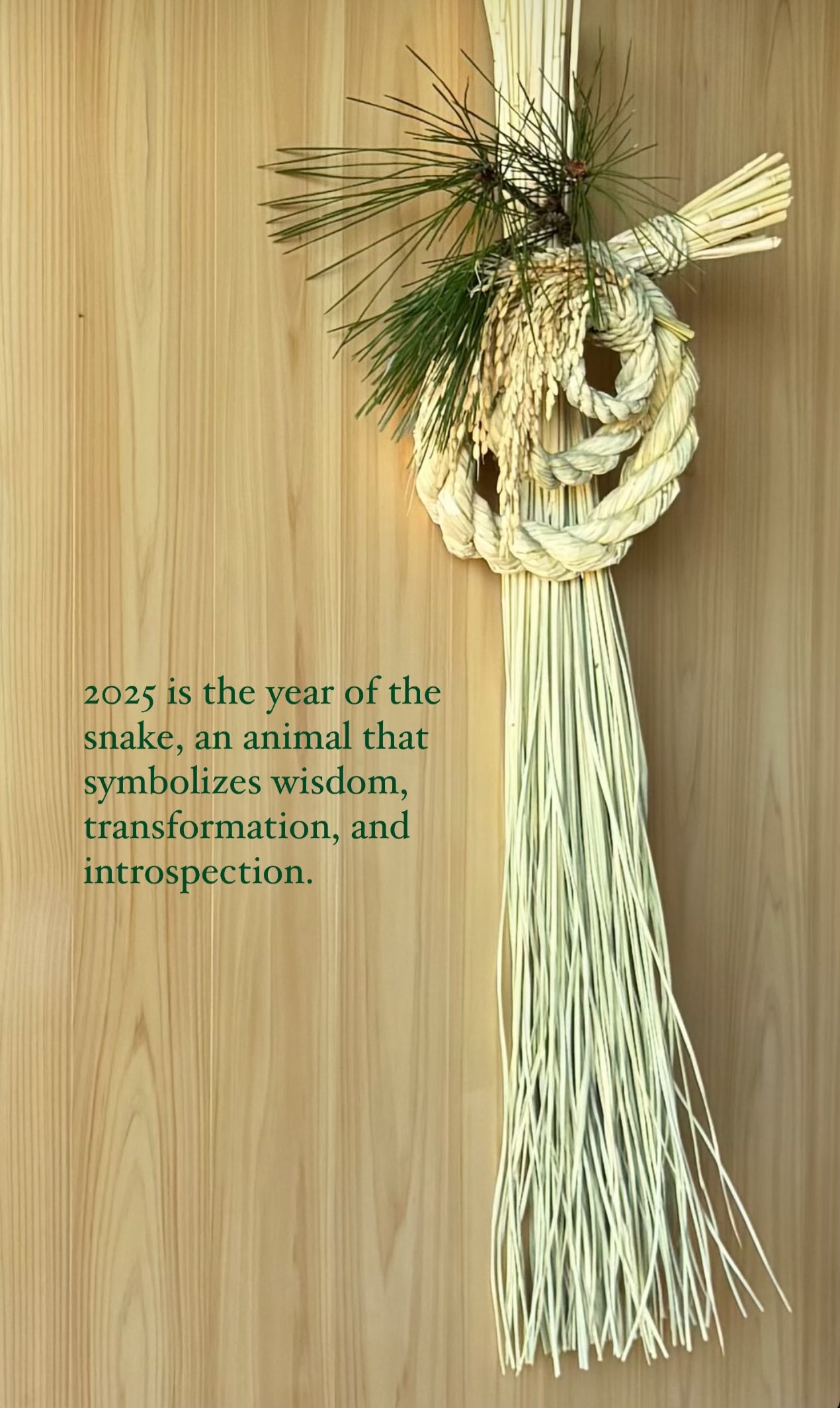

Japan Surprises 2025

Ten twists & turns that would change the global Japan narrative in the Year of the Snake

A good forecast is like a beautiful Bach sonata. It follows a quantitative or intuitive logic, creates a future as an inevitable consequence of the past. In contrast, a surprise is like an inspired Jazz riff. It catches us off guard, forces a break; and once heard, that surprise riff will never let go, will shape our future perception and narratives forever. For 2025, the only certainty is that this year of the Snake will be shaped by both, existing trends evolving and genuine surprises.

Here is my annual list of ten possible Japan surprises for 2025 - and best wishes for a happy, prosperous, and healthy New Year to you!

1. Japan inflation spiral

Japan’s inflation will accelerate and end up significantly higher than inflation in the U.S., in Europe and in China. Why? On top-of continued cost-push inflation from a weak Yen, demand-pull inflation gets turbo-charged by wages rising faster than expected, the real estate boom delivering more powerful positive wealth effect than anticipated, and both monetary- and fiscal policy remaining too stimulative for too long. Yes, I do worry about “too little, too late” from BoJ Governor Ueda.

2. LDP win big, thanks to a “no-more-tax-hikes” policy

The LDP lost control of parliament in 2024. Since then, Japan has been stuck with an unimpressive lame-duck minority government and increasingly divided LDP leadership. A big positive surprise would be the LDP re-asserting —against an increasingly vocal and organized socialist opposition— its pro-business, pro-risk-taking, pro-deregulation leadership credentials. Good way to start: the LDP unites behind a hard commitment to not raise taxes — not corporate, not income, not consumption, not asset taxes. A strong LDP comeback in the likely double election this summer? Now that’s a positive surprise from where it is least expected - policy & political leadership. Spoiler alert: the opposition parties are very hungry for power, increasingly organized, and may very well beat the LDP to the no-tax-hike agenda.

3. Next-gen LDP leaders push abolition inheritance tax

Over the coming 15 years, an estimated Y500–750 trillion of household wealth will become unstuck due to inheritance. That’s 1–1.3 times GDP. Much of this will be used to pay down the national debt. At more than 50 percent, Japan’s inheritance tax rates are famously high. Paying down debt makes accountants happy, but creates deflation, not growth or investments in future prosperity.

A long-overdue, positive surprise would be if Japan’s next-generation leaders started to demand reform of the inheritance tax. Japan could take a clue from the otherwise much-admired Nordics. Recently, Sweden cut its inheritance tax to zero and Denmark dropped its to 15 percent—policies promoting ways to channel the accumulated wealth of the baby boomers into future investments. Now that’s worthy of being called New Capitalism – and a new LDP will to power & prosperity (and definitely not something the more socialist-minded opposition will ever embrace).

4. Japan wins major global defense contract

Japanese national security policy made a clear turn in 2022, and the defense budget will be more than doubled, from one to two percent of GDP. A real surprise would be if, on top of increased defense spending, Japan won a major global defense contract. The greater the evidence that Japan’s spending on national security is actually an investment in global competitiveness, the happier taxpayers and investors will be. Not just a surprise but a de-facto miracle: this contract is not for “hardware” but for “software”, ie. cybersecurity Made-in-Japan.

5. More buyouts than IPOs

Japan’s management and levered buyout boom accelerates, spurred on by increasingly vocal shareholders and an activist stock exchange. Why stay listed and deal with all those outsider demands, when you can be private and in control of your destiny?

The surprise: 2025 may be the first year when more companies go private and delist from the stock market than new startups going public and listing via IPOs. As Japanese banks become more and more profitable -and thus keener to lend- this `surprise` is close to a forecast. The battle between foreign Private Equity and corporations bidding against local insiders and `white knights` will not just be fun to follow, but will pull Japanese equities out of the value trap.

6. Japan Inc starts buying start-ups to grow

Japanese CEOs begin to step out of their comfort zone and start to buy start-ups for future growth rather than just reply on inhouse R&D teams. One reason for US corporate dynamism is the aggressive use of `outside` innovation to supplement or improve or disrupt `inside` businesses – 90% of US start-up exists are acquisitions (while 90% of Japan start-up exits are IPOs). Mark my words: Japan’s new generation of CEOs are taking risks, are ready to challenge the complacent business-as-usual mentality of their inside executive teams by looking outside. Japan’s next-Gen business leaders are keen to create a positive legacy, are not afraid to try and make 1+1 = 3 or 4.

7. Foreign home-helpers for Japanese

Japan deregulates home-helper visas so that Japanese working families can sponsor home helpers and domestic-care givers. The combined problems of a growing labor shortage, a falling birthrate, and more Japanese females aspiring for a professional career cannot be solved without outside help for the family. A very positive surprise would be if Japan followed the Hong Kong and Singapore model. There professional couples can sponsor home-helpers, with proper supervision and governance by local authorities. Here is a pragmatic solution to reverse the declining birthrate as well as reduce the runaway costs for public child- and old-folks social&medical support.

8. Trump’s tariffs work – China opens up & the `new cold war` is over

The world worries about the possible negative effects of President Trump’s trade war rhetoric in general, the threat of tariffs against China in particular. But what if the threat works and does deliver a constructive re-engagement between America and China? Could 2025 mark the beginning of the end of the ‘new cold war’ between the two superpowers? A long shot scenario, I know; but if it were to happen Japan would be a likely loser: global investors would re-invest in China risk assets; foreign direct investment into China would re-accelerate; and, most importantly, China’s globalization would get turbo charged with, for example, China’s automobile and machinery companies allowed to build factories and create jobs in the United States, i.e. competing head-to-head against Japan.

Sure, it seems unlikely -- America’s internal politics is easier managed when having an external enemy; but if “TeamTrump” can indeed broker a big new deal with China, the ‘Japan premium’ will be at risk.

9. China is forced to start a currency war

Another worry for a negative surprise for Japan in 2025 comes also from China, but this time from almost the opposite side from the above: failure to re-engage with America forces a rise in Chinese unemployment, more China deflation, more idle capacity and surging bad debt. Already, China has been trying to stimulate growth by easing both monetary and fiscal policy since the summer of 2024. If the economy does not respond and does not begin to accelerate by late-spring 2025, currency devaluation may become the last option. China being forced to start a currency war by the compounding forces of domestic deflation and U.S. protectionism would force a dramatic disruption for not just Japan’s cyclical competitiveness, but for Japan’s future prosperity.

10. Japan’s `Sakura 15` women’s rugby team wins the world cup

On September 27, the 2025 Women’s Rugby World Cup final will be played at Twickham stadium, London. Japan’s `Sakura 15` are ranked 11th best in the world. I’m told reaching the quarter finals is possible, and making the finals would be a sensational surprise. But hey, Japan beating the English on home turf would be good fun, desho? Go Sakura 15, go.

Not sure the tone on inheritance tax is fair there. There is a reasonable tax free allowance, and over 90% of estates in Japan pay no inheritance tax at all.

The top inheritance tax band only applies to estates worth over 600 million yen -after the tax free allowance has been applied.

Thank you for this intriguing list. I certainly hope that many of these predictions do indeed come true -- especially #3. What do you think about the potential for a closer alliance between India and Japan - particularly in relation to the so-called "China Plus One" strategy that Japanese companies may be considering (beyond the current shift away from China to Southeast Asia)?