Ueda-sensei on the move

Japan bond markets are now freed from BoJ control -- normalizing short-rates is next on the agenda

By popular demand, here a brief summary of my thoughts on Japanese monetary policy after today’s board decision. My numerical forecasts remain unchanged — by end-2024, I expect 10-year JGB yields to be at 2-2.5% (from just below 1% today), anchored by a BoJ policy rate at 0.5-0.75% (from a de-facto zero rate today). I also continue to expect for some form of Yield Curve Control to still be in place. Like a good master teacher, Ueda’s BoJ will neither abandon its students - domestic investors; nor its masters - the national treasury - to fend for themselves without expert guidance and coordination. The “Abe-Kuroda Accord” of explicit BoJ-MoF cooperation is poised to stay. Local expediencies — public debt-to-GDP at over 2.5-times national income — and global uncertainty command as much. We live in dangerous times - Japan’s elite stands united.

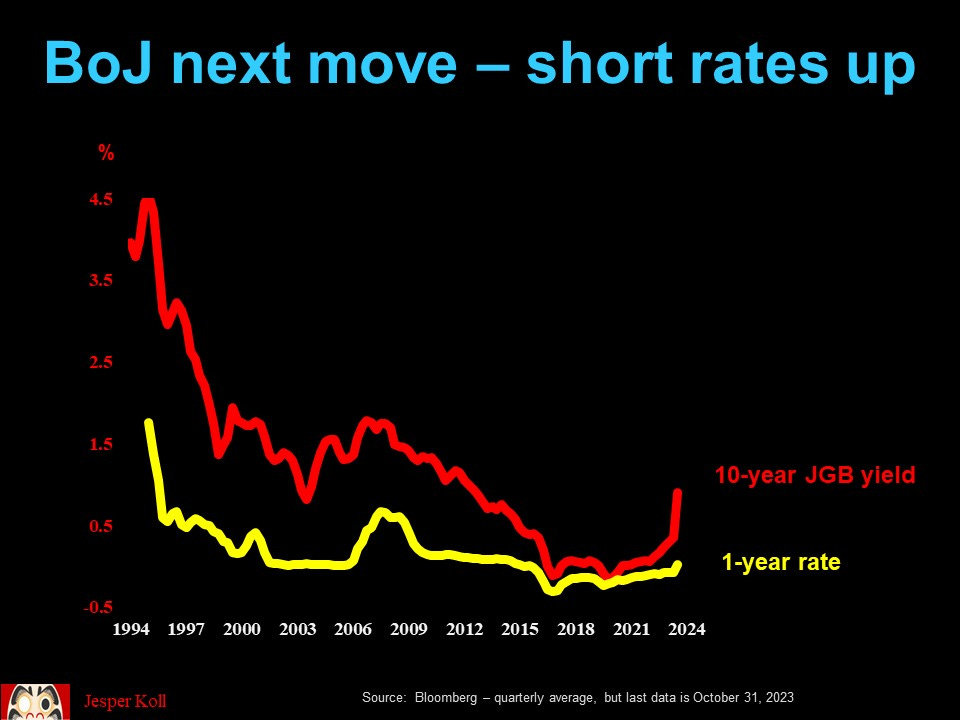

Japanese monetary policy has changed quite dramatically over the past year. Twelve months ago, 10-year bond yields were stuck at zero. Today they are at almost 1%. In the local context this is an enormous change.

In the global context, of course, Japan stands out as a huge laggard, with global investors quick to accuse the BoJ of being “behind the curve”. But unlike the Federal Reserve in America or the ECB in Europe Japan has been facing very different fundamentals in the current global inflation cycle:

there has been no real “smoking gun” suggesting real risks of demand-pull inflation.

and, more importantly, Japan has a political reality that actually allows for fiscal policy to act fast and decisively: Prime Minister Kishida has a 100% record of turning bills into law. Specifically, he has passed at least four extra budgets and spending allocations for public subsidies to those hurt by supply shock / imported inflation. This is textbook stuff, exactly the way one should deal with temporary supply disruptions or terms-of-trade shocks. Japan actually acts rationally and policy gets made efficiently, competently, and in a refreshingly ‘no nonsense’ kind of way. No government lockdown or Brussels inertia in Tokyo…

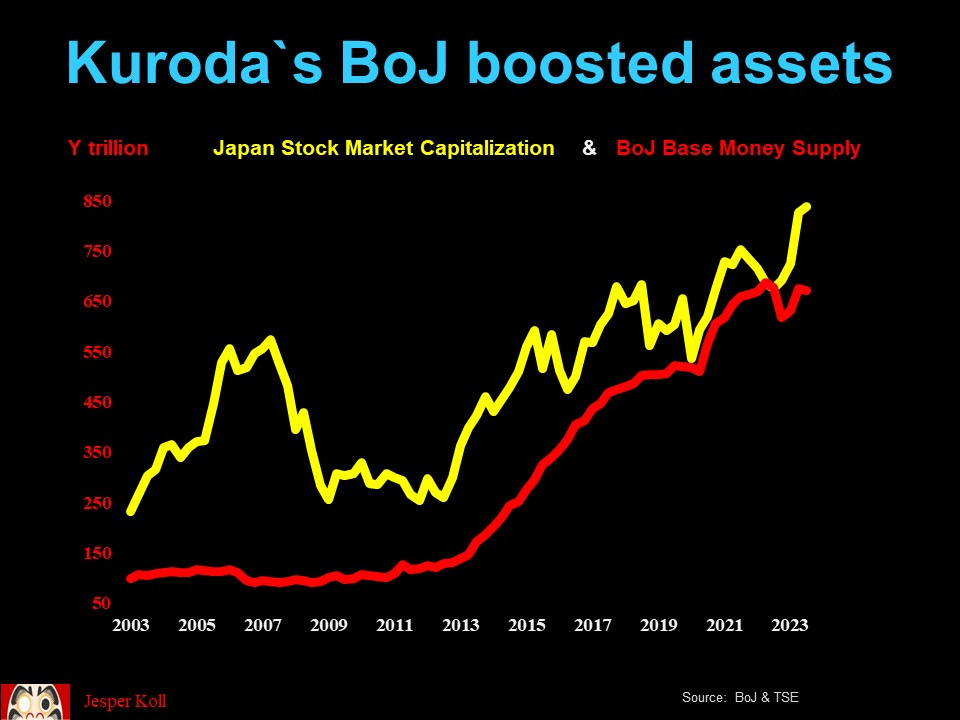

Importantly, the BoJ has not done nothing, but has actually used the higher degrees of freedom offered to it by a functioning government to exit form the extraordinary emergency policy put into place during Abenomics:

they started by stopping to intervene regularly in the equity markets, with ETF purchases basically stopped since 2021 (although, they do maintain a ‘war chest’ for potential ETF purchases and they did buy a small amount in early October when the market had dropped almost 2% — this is what I mean about the teacher not abandoning his/her students…).

they did liberate the bond market from the YCC strangle, raising the cap first from zero to 0.5%, then to 1%, and now abandoning the hard cap for a soft-cap reference rate guidance.

From control to supervision

Make no mistake: after almost one-decade of strict BoJ market control, it was only prudent to adopt a gradualist approach to allow re-liquification of the bond market by private actors. Today’s move to remove the “hard ceiling” of 1% for the 10-year JGB suggests the BoJ is confident now that private investors are ready to take over as the main force in bond market price discovery. And just as with the EFT policy, yes, the BoJ will not hesitate to intervene and send a strong message should JGB market volatility get out of hand.

From here, the next step will be the normalization of short-term rates. Clearly, the room for error is potentially bigger. Unlike JGB yields — where the treasury is the primary and most significant borrower — short-rates command a more complex web of dependencies.

For one, almost 80% of household mortgages are floating rate mortgages. If mortgage rates were to rise by 1-percentage point, wages would have to rise by almost 15% to keep affordability at current levels. Typically, switching from a floating rate to a fixed rate mortgage already forces a step-up in interest costs of over 1.3-to-1.6 percentage points.

So far, there has been no significant increase in short-term market rates rates. From here, I expect this to change, with the 1-year and 2-year rates poised to move higher as it becomes clear that Governor Ueda’s next move will be the normalization of the short-term policy rate anchors.

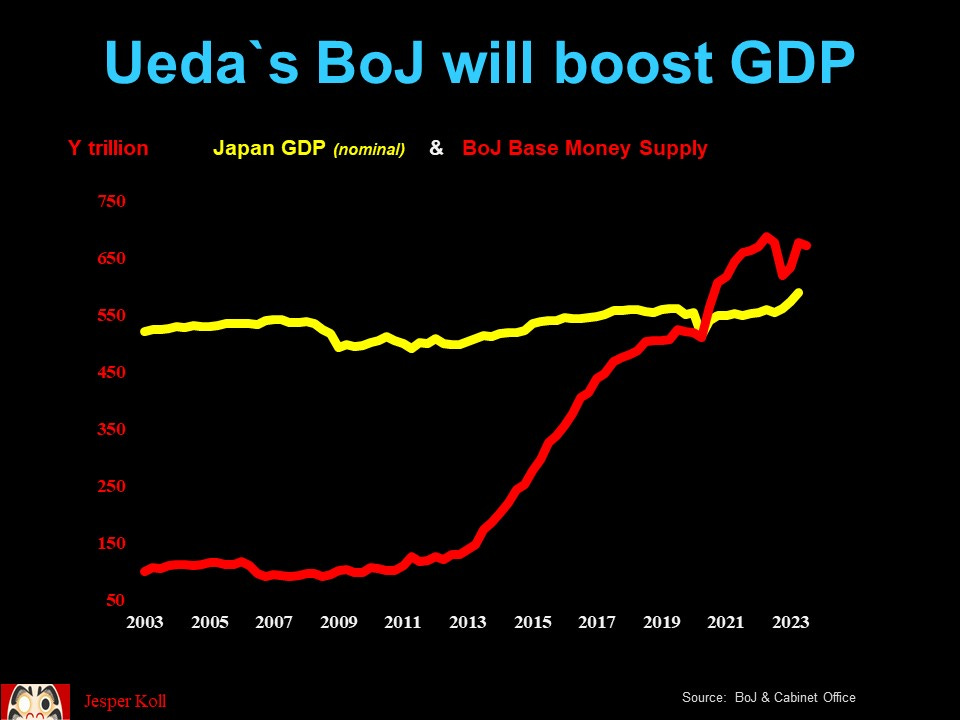

To get there, we’ll need to see further progress of nominal national income accelerating further towards my target of 5-6% sustained growth. This, of course, requires wage and income growth of similar magnitudes.

Importantly, both BoJ and MoF have recently begun to argue that Japan’s output gap - the gap between potential growth and actual growth - now has closed for the first time in over twenty years. Make no mistake - Japan is no longer just on track to escape deflation, but is well on its way towards sustained demand-pull inflation.

What could go wrong?

Governor Ueda’s normalization process faces two principal risks.

internally, it would be Prime Minister Kishida flip-flopping and presenting a 2024 budget that actually hikes taxes. This seems unlikely at this stage, by ironically the longer the downward slide of Kishida’s popular support persists, the more vulnerable the Prime Minister gets to pressure from the MoF to stop making fiscally irresponsible policy promises. Technocrats are very quick to stop supporting politicians who are on the out.

More to the point: Governor Ueda does not want to find himself in a situation where both fiscal- and monetary policy are being tightened at the same time. Unfortunately, PM Kishida’s recent proposal to ‘cut taxes in 2024, and hike them later’ actually raises that risk for 2025/26. Remarkably, surveys suggest that more than 70% of the Japanese people are opposed to tax cuts for exactly the same reason. Looks like their economic reality instincts cannot be fooled by a Prime Minister who seems increasingly desperate to buy affection.

externally, it would be a U.S. hard landing, which would trigger an about-turn in Federal Reserve policy towards aggressive easing. The combination of a US demand contraction and a falling US dollar could easily tip Japan back towards deflation.

I have deliberately stayed away from the exchange rate, and promise to pick-up this topic in a future piece. For now, let me just remind you that the primary reason for having floating and free exchange rates is precisely so that different countries have the freedom to implement exactly that monetary and fiscal policy combination they see best fit for local realities. The exchange rate is an outcome, is part of the adjustment process, but it is not a policy target. I very much doubt Ueda-sensei (or anyone else in the policy elite) has any intention whatsoever of abandoning this foundational principle. Intervention when volatility gets out of hand, absolutely; hiking rates to defend the Yen? Very unlikely.

Be this as it may — Governor Ueda has now completed the groundwork for policy normalization. Pushing up the yield curve by raising short-rates is now the next move. Expect policy rates at 0.5-0.75% and 10-year JGB yields at 2-2.5% by the end of 2024.

Great commentary, thank you.

Loved this commentary as a French-Canuck looking to immigrate permanently (I previously lived in Japan, and wish to return), this gives me strangely enough a great deal of hope for her future.

Really admire your superior knowledge of economics and summary of the situation and of the Yen. Definitely gonna be following your substack in the future mon ami.