Warren Buffett & Japan: Turning pages

Guest contribution by Andrew McDermott - what Buffett's Japan allocation reveals about investment strategy & principles

My friend & fellow investor/strategist Andrew McDermott has been a close ally of Warren Buffett on all things Japan for many years. Here are some of Andrew’s thoughts on how Warren Buffett approaches Japan and how the Buffett Japan allocation reflects deeper insights into the real-world investment principles for success - study, patience, wisdom, ethics, not the size of your team and certainly not paying fees to access the elites. And yes, nobody cherishes the public good that is the public equity market more than Warren Buffett. Simple does it….works everywhere, especially Japan….enjoy & many cheers ;-j

Turning pages with Warren Buffet in Japan

Warren Buffett ended his spectacular career as America's greatest investor with a single actionable idea: Japan. In his last ever annual meeting, he and Greg Abel said the following about Berkshire's $20 billion investment in five Japanese companies:

Turning every page is one important ingredient to bring to the investment field. And very few people who turn every page are going to tell you what they find, so you've got to do a little of it yourself. [In 2020 I found] five [Japanese] trading companies going through a little handbook that had two or three thousand Japanese companies in it.. They were selling at ridiculously low prices. So I spent about a year acquiring them and then we got to know the people better. And everything that Greg and I saw we liked better as we went along. In the next 50 years, we won't give a thought to selling those. Japan's record has been extraordinary actually. They have different customs…that's true around the world. We don't have any intention in any way of trying to change what they do, because they do it very successfully. We will not be selling any stock. That will not happen in decades, if then. We've got $20 billion invested, but I'd rather have $100bln. We really do hope to do incremental things with them globally…and that's why we're building that long-term relationship with them. Greg Abel, 2025

Mr. Buffett's words and deeds have been ignored by an investment industry inextricably entwined with the People's Republic of China. I have had the opportunity to observe the former and the misfortune to observe the latter in person over the past twenty-five years. Perhaps my experience and Mr. Buffett's parting advice can encourage the leaders of our elite organizations to "turn the page" from the PRC to Japan and from private equity to public markets.

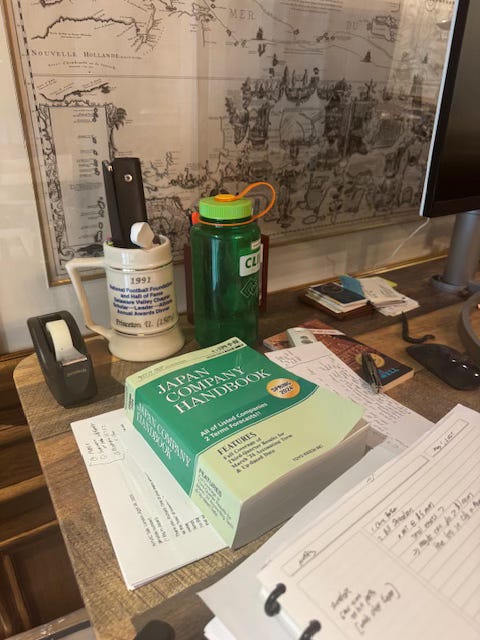

In 2012, when most investors had washed their hands of Japan and embraced the PRC, Mr. Buffett invited my partners and me to Omaha to discuss our curious allocation of nearly 100% of our global portfolio to Japanese equities. We arrived early for our meeting on a freezing Omaha morning. Mr. Buffett opened the door himself, offered us a Coke, ushered us into his office and proceeded to ask us questions for an hour and a half. As we left, he remarked that he'd rather invest in Japan than anywhere else in the world and encouraged us to call him directly if we had any ideas. We did make a few calls over the years, but he ultimately found his own ideas the old-fashioned way: by "turning pages" in the same Japanese Company Handbook that sits on my desk as I write. Over the eight years between our meeting and his decision to allocate billions of dollars to Japan, he became increasingly comfortable with Japanese companies and increasingly uncomfortable with the PRC and with the actions of leveraged private equity investors.

Elite investors proceeded in the opposite direction. While treating Japan with a combination of apathy and contempt, they competed with each other to access the China fee machine. Oxford's CIO spoke for the consensus last year when she observed to my friend Simon Brewer that

Ultimately, the market dictates the price. And if the market doesn’t care, that’s really hard. Like you, I was a big believer in Japan. I saw the stats. It did nothing for years. That’s quite a high opportunity cost for our capital…Chris Gradel [of PAG, a China fund] is on our investment Committee…he’s fantastic when it comes to China.

Access to the "deep mainland connections" of funds like PAG required a multi-pronged effort that encompassed the creation of institutional relationships with Chinese universities, the hiring of staff with direct links to the Chinese Communist Party, and the cultivation of relationships with those perceived as CCP insiders via board relationships and charitable giving. The payoff for the most connected investors was preferential treatment by the most coveted PRC specialists, including PAG, Hillhouse and Sequoia China (now Hongshan). As late as 2022, endowments competed for spots in the 50% oversubscribed Hongshan offering that included stakes in Bytedance/TikTok and several other companies now deemed threats to national security by bi-partisan Congressional action. Yet most elite universities continue to hold positions like Bytedance in their portfolios. The sums allocated to China are staggering. Mr. Buffett's $20 billion investment in Japan pales in comparison to the $100bln raised by Hillhouse alone. As the Wall Street Journalreported last year,

U.S. endowment and foundation leaders, including many who trained under [Yale's David] Swensen, lined up to hand his Chinese protégé [Lei Zhang] money. The long list of [Zhang's firm] Hillhouse investors in recent years includes the Ford Foundation, the Metropolitan Opera and top universities such as Princeton and Stanford. "One of the best things we ever did was invest with [ Hillhouse said former Notre Dame CIO John Malpass]." On a visit Zhang made to Shanghai in October, China made clear Zhang is in its good graces—and a useful figure to sell the country’s openness to investment. —[when] Zhang was welcomed by the Shanghai Communist Party secretary.

Oxford's CIO rightly appraised the opportunity costs incurred by the Japan and China positions taken by elite investors. Mr. Buffett's experience suggests that she may be confusing ends and means. Close connections with PRC specialists have undoubtedly brought short-term benefits to schools like Oxford and my alma mater, Princeton. Mr. Gradel has generously shared the fees generated by his China activities with Oxford in what Oxford calls "the gift of a generation" even as its parting chancellor bemoans the "wickedness" of the CCP. Tencent, which the DOD recently categorized as a "Chinese Military Company," partners with private equity firm Wythes to fund Princeton's Center on Contemporary China. But PRC riches come with a cost in missed Japanese opportunities.

In almost every financial organization of any size, the "Japan hands" have been displaced by "China hands" over the past thirty years. A brief glance at the boards of directors, the investment staffs or the managers employed by the most elite endowments and pension funds reveals a near 100% correlation between financial success and proximity to China, either as a direct investor, a service provider or a fund raiser from the Chinese state pension funds who figure prominently in the accounts of firms like KKR, Bain and Cambridge Associates. If these individuals have spent any time in Japan at all, they have done so as antagonists, backing activists or private equity firms whose sole objective is to change how Japanese companies operate. Such an approach complicates building the sorts of relationships Berkshire has forged.

The great irony of Mr. Buffett's success is that he is neither a "Japan" nor a "China" specialist, yet he has found investments and built relationships using the same tools that served him for six decades in the United States. As Mr. Buffett fades into the sunset, we can do worse than learn from his example. While the smart money at Yale scrambles to sell private equity portfolios at a discount and as private equity firms themselves dig deeper to find even more leverage, spare a thought for Mr. Buffett and the public good that is the public equity market. In the first quarter, the biggest buyers of Japanese equities were Mr. Buffett and Japanese companies themselves. Both have used their carefully husbanded capital to take advantage of market stress at the same time that they have announced enormous investments in the re-industrialization of America, from our energy to ship-building to marine cranes. Unsurprisingly, Mr. Buffett's Japanese investees have been major contributors to both the buybacks in Japan and the investments in industry that many Americancompanies are too levered to contemplate.

Mr. Buffett's parting gift to a conflicted and over-extended investment industry could be the gift of simplicity. As we enter what my friend Grant Willams calls the 100-year pivot, perhaps we might consider returning to the plain-old investing that Mr. Buffett has practiced for sixty years. Perhaps the image of a solitary Warren Buffett, turning pages in a book of thousands of public equities to find a few qualifying investments, will remind us that the key attributes of successful investing are patience, wisdom and ethics, not the size of your team or your access to influential members of the Chinese Communist Party. A return to plain-old investing alongside partnership with our closest ally could cure what ails many of our most elite institutions. What a boon this would be from a great American.

The opinions expressed are my own. They are not intended as investment advice.

Andrew McDermott - Nashville May 4, 2025

For a more detailed bio and more of Andrew’s thoughts, please see :

Really enjoyed this - thanks 🙏

Minor typo in the opening: ‘nobody questions the pubic good’.