Who's afraid of inflation? Not Japan

A hyper-competitive domestic industrial structure and competent government are poised to keep Japan the low-inflation envy of the world

July 14, 2022

A specter is haunting the world economy, the specter of inflation. Economists are fiercely debating from where it has come from; politicians are busy blaming their opponents for it; and, as always, the average citizen is left with no choice but to pay up. Yes, inflation is real when you now must pay $50 for your $40 haircut that you used to get for $25 when you had hair (1).

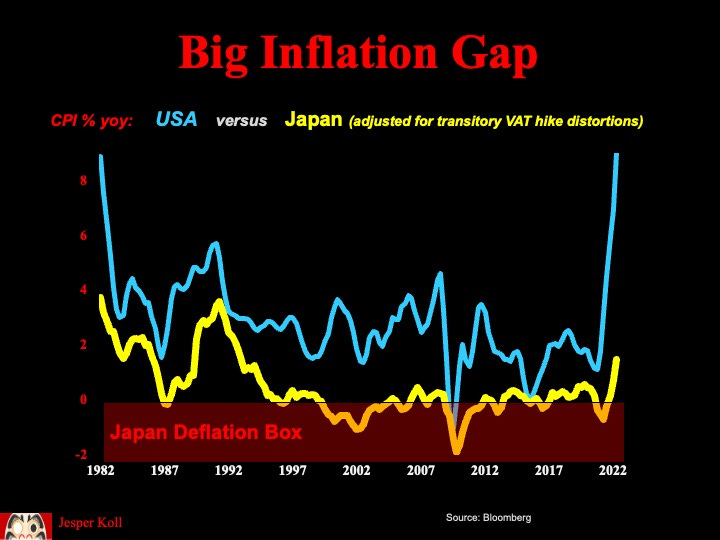

Japan stands out as the one economy in the world with a relatively benign inflation shock. Where in America, consumer prices are now up by more than 9% from a year ago, Japan’s CPI prints barely above two percent. This may come as a surprise, given the global nature of the inflation shock: excess money and credit, supply bottlenecks, the war in Europe, the surge in pent-up demand as the pandemic abates.

Further, the global cost-push pressures -- from rising energy, electronic components, and food prices – have been compounded by a falling Yen: in the United States, the price of oil is up approximately 60% in US dollars since the end of December. In Japan, the Yen price of oil is up almost 90%. And yes, America is a net exporter of energy - and food - while Japan is one of the worlds largest importers of energy - and food.

So how come that, despite greater and more severe exposure to global inflationary pressures, consumers in Japan are much less affected by the global inflation tsunami than they are in America?

There are two primary reasons:

1) the government here is not afraid to intervene in markets to preserve the purchasing power of the people

2) Japan`s domestic industrial structure is much more cut-throat competitive.

The net result of this seeming contradiction – government intervention going hand in hand with extraordinary competition – is a much lower inflation equilibrium here in Japan compared to what we get in the less interventionist and more oligopolistic US economy. There, a few producers and distributers are price-leaders and effectively control the market.

Let`s start with the industrial structure. In the United States, of all the industries in the services and the manufacturing sectors –from hairdressers to pharmacies to steel makers to internet service providers and semi-conductor companies and so on – on average, the top four players in each industry control approximately one-third of their respective total market. In contrast, here in Japan the leading four companies command less than 15%.

Clear speak: Japan is much more fragmented and more cut-throat competitive, while America`s industrial structure has been consolidated and has de-facto become more oligopolistic or oligopsonistic.

The net result is significantly lower price power for suppliers of goods and services in Japan relative to the United States. No matter how differentiated a product or service you offer in Japan, within days or weeks, a competitor will follow suit offering something similar but at a lower price point.

Fun fact: just about every two weeks, a new soft-drink is launched in Japan, and just about every 12-15 years, the equivalent of the entire central Tokyo`s Grade A office supply comes onto the market. Good luck raising soft-drink prices or rent.

Capitalism without Costs

There are, of course, complex reasons why excess competition has prevailed in Japan. The first investment report I ever wrote in Japan back in the late-1980s, was entitled `Capitalism without costs`. In it, I argued that corporate Japan effectively had no cost-of-capital constraint. In contrast to those in the United States, owners of capital in Japan simply did not hold corporate executives accountable to maximize return on capital.

Today, this still holds true, because just as the changes in capital stewardship and corporate governance have shifted private sector capital allocation closer to the American model of demanding higher capital returns, Japan`s public sector intervention in capital markets has been stepped-up dramatically. The Bank of Japan has purchased up to 10% of the TOPIX equity market and has been capping the cost of long-term debt at just about zero for almost one decade now (1).

Whether this public sector provision of a cushion in capital markets is good or bad policy is subject to debate. But, for the purposes of trying to determine whether Japan does or does not face an inflation threat, there is no question that the reality of a relatively low and stable cost of capital has kept many marginal companies afloat. This, in turn continues to restrict the price power of Japan Inc. in domestic markets. If your competitors don`t have to care about delivering a proper return or profit, whoever raises prices is doomed to lose customers and market share.

Which gets us right back to the first reason Japan is not afraid of inflation: government intervention and de-facto price controls.

When you analyze Japan`s consumer price index, you`ll quick find that just about one-quarter of the goods and services for which Japanese consumers pay are subject to government rules and regulation, i.e. de-facto price controls.

Health care services and pharma are an obvious important example, as is education, much of transportation, as well as several staple foods. For food, the Japan Agriculture Cooperative, JA or 農協, plays a key part in expertly balancing fiscal support for producers while preserving the peoples` purchasing power.

Political leadership, not grandstanding

The willingness to fight immediately against threats of inflation undermining consumers` well-being was just demonstrated by Prime Minister Kishida. In April/May he drew a line in the sand for the retail price of regular gasoline at Y170/liter (it was approximately Y145-150/liter a year ago), and passed in record time a supplementary budget to fund this PKO, price keeping operation. After Sunday`s upper house election victory, he promised speedy implantation of yet another extra fiscal package worth about 1% of GDP, again expertly designed by Japan`s elite technocrats to shield Japanese citizens from the loss of purchasing power forced by imported cost-push inflation (2).

The contrast to US government priorities could not be greater: not only does Japan`s government see its primary mandate is to protect its citizens from economic shocks, but it also has the necessary parliamentary control and supermajority to act decisively and fast. It is both the willingness to act and ability to act `in real time` that, in my view, make Japan`s parliamentary democracy and model of capitalism a worth role model for the free world.

The BoJ is not the only adult in the room

But be that as it may. Practically speaking, the fact that Japanese political leaders actually can -- and do -- mobilize fiscal resources in a timely manner allows much greater flexibility for Japan`s central bank. Where the de-facto political gridlock in Washington makes it unlikely government policies can be mobilized to cushion American consumers against the ills of inflation, here in Japan the government can be counted on. No wonder, then, that the United States must rely on the Federal Reserve as the lone fighter against inflation, while here in Japan, the Bank of Japan gets plenty of backing from all the other parts of the policy tool-kit available.

All said, the current strong surge in global inflation is very real and is certainly having a strong impact on Japan. However, the Japanese system is responding well to the challenges and is doing so on its own terms. Resilience to shocks is what Japan excels at and, in my personal view, the in-built systemic priority placed on preserving consumer purchasing power makes it unlikely inflation will force another lost decade.

Thank you for reading. as always, comments welcome….and if you enjoyed the piece, please like and forward to a friend. Thank you & many cheers ;-j

+ For a more specific focus on how Japan`s inflation dynamics will impact Bank of Japan policy, please look at the previous post, Three Cheers for Governor Kuroda.

+ This piece was published by the American Chamber of Commerce earlier this month.

Notes :

(1) Shoutout to the always brilliant Doomberg from whom I first learned how to connect inflation to baldness…

(2) The BoJ has effectively stopped intervening in the equity markets since early 2021, after purchasing 1-1.8% of TOPIX market cap on average per annum over the previous eight years.

(3) Japan has a long and consistent history of speedily enacting fiscal support to cushion domestic demand from deteriorating terms of trade in general, cost push inflation in particular.

Thanks for sharing, Jesper sensei! Will share with our 250 TeamFirst members.

Danke…..