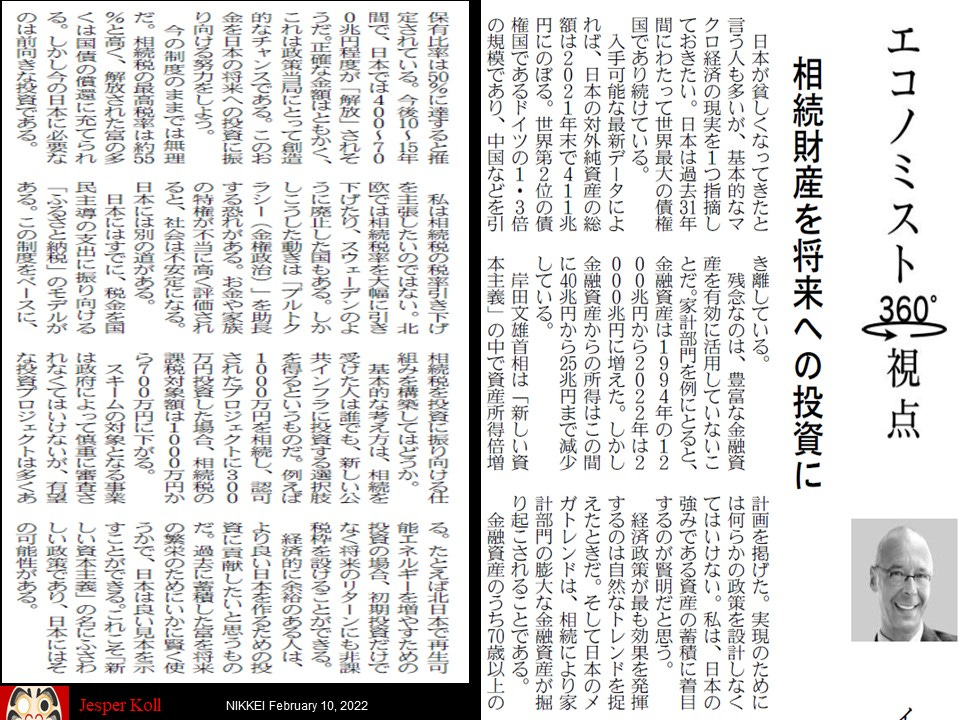

From inheritance liability to investment incentive

A modest proposal to mobilize Japan's stock of savings for investment flows & future prosperity (rather than just debt repayment....)

The following is an English version of my regular NIKKEI column, published February 10, 2023. Since publication, several politicians and ministries have reached out, each looking to tweak the proposed scheme to promote their respective agenda: great idea, Jesper. We could use this for digitalization…for green energy projects…for childcare support projects...for defense spending. I’m not holding my breath, but reform of inheritance and gift tax rules would mark a true ‘new capitalism’ in Japan.

From inheritance liability to growth investment incentive

Japan is a very rich country. Of course you’re not supposed to say so in polite company. Japan’s elite prefers the ‘resource poor nation’ narrative and, if anything, has perfected the art of complaining about lost decades or lost generations. Still, the fundamental macro economic reality is this: Japan is the world’s largest creditor country and, amazingly, has actually been the world’s largest creditor country every year for the last 31-years.

Specifically: total net assets stood at $3.2 trillion at the end of 2021 (and almost certainly rose again during 2022 - the latest available data is for end-2021). This was 1.3-times more than those held by Germany, the world’s number 2 creditor, and was well ahead of China. So yes, Japan is a very rich country. Its stock of asset is the envy of the world.

Unfortunately, being rich in financial assets does not mean that the assets are being deployed effectively. In Japan’s case, quite the opposite is true. Take the household sector: financial assets have basically doubled from Y1000 trillion to Y2000 trillion over the past thirty years. Amazing this asset-doubling happened while wages and disposable income were basically stagnant; and while income from those assets dropped from Y40 trillion in 1994 to Y25 trillion in 2022.

So PM Kishida’s “New Capitalism” agenda is right to suggest an asset-income-doubling plan. But to actually achieve this, some policies worthy of being called “new capitalism” must be designed. To start, it would be wise, in my opinion, to focus on Japan’s undisputed strength - the enormous stock of assets accumulated.

Japan’s domestic mega trend - inheritance assets

How? Economic growth policies work best when they seize upon a natural trend. And inside Japan, the most powerful megatrend is the unlocking of Japan’s enormous household sector financial assets because of inheritance.

Specifically, it is estimated that of the famous Y2,000 trillion of household financial wealth, as much as 50% is owned by people aged 70 or older. This implies that somewhere between Y400-700 trillion will get “unstuck” due to Japan’s natural demographic destiny over the coming 10-15 years. (Japan’s GDP is approximately Y550 trillion….).

While the exact numerical estimates may be subject to debate, there must be no doubt that here we have an unprecedented opportunity for policy makers to become creative. The goal is simple: let us try to channel these funds towards investments for Japan’s future.

Under “old capitalism” and current policy settings this will not happen. Inheritance tax rates run very high at around 55%. This means that much of the stock of wealth freed-up by inheritance and generational transfer is destined to pay-down government debt. Obviously this is backward looking – paying down debt is paying for past consumption and past investment. What Japan needs is forward looking investments. Here the coming megatrend of inheritance offers a once-in-a-generation opportunity to do so.

Importantly, I am not advocating a cut in the inheritance tax rates. Far from it. I know that some of the usually much admired Scandinavian countries have dramatically reduced inheritance tax rates. Sweden abolished it completely just a couple of years ago. This is potentially dangerous as it opens the possibility of a ‘plutocracy’ developing. Societies can quickly become unstable when money and family privilege are valued higher than ability, initiative, and the belief that value is based on merit. Japan must - and can - do better.

Furusato Nozei 2.0 : from flow to stock

The good news: Japan already has a model scheme that effectively take traditional tax liabilities and channels them into citizen-directed spending: the FurusatoNozei (1). Building on this, a similar scheme can be created to channel inheritance tax liabilities into investments.

How? The basic idea is that anyone who receives an inheritance gets the option to invest in projects or investment schemes that build new social and public infrastructure. The amount invested is tax free, not against income taxes, but against inheritance tax due. So someone who inherits, say, Y10 million and makes a Y3 million investment in approved projects, will now be taxed on Y7 million, not Y10 million.

The projects and funds eligible for the scheme will, of course, have be carefully vetted by the government, just like the goods and services eligible for the Furusato Nozei are. There are many possibilities to design this scheme for maximum policy impact. For example, if your policy goal is finance green energy projects in Northern Japan or public university deep-tech start-ups, offer the tax exempt status not just to the initial investment but also to potential future investment returns. But, like the furusato nozei, locally focused initiatives must be the integral part this scheme, in mypersonal view.

All this requires reform of both, the gift tax system and the inheritance tax system. This will require enormous political capital, but, in my view, could very well end up being enormously popular. At its core, it required political leadership to create a new philosophy: give individual asset owners an opportunity to self-direct their accumulated wealth towards concrete projects that will create future prosperity. (2)

Those with financial means want to create a legacy, want to contribute towards investments that create a better Japan for their grandchildren. Unlike China, Japan got rich before it got old. Now the coming megatrend of inheritance allows Japan to set a positive example of how these riches accumulated in the past can be used wisely for the creation of future prosperity. Now that’s a policy directive worthy of being call “new style capitalism”. Japan has the potential.

As always, comments welcome. Thank you for reading & many cheers from sunny but freezing Tokyo ;-j

Japanese version: NIKKEI & a big thank you to my editors there

(1) Furusato Nozei allows Japan residents to channel part of their local tax liabilities into consumption of regional goods & services. It was designed and implemented under the leadership of former Prime Minister Suga Yoshihide in 2008.

(2) there are plenty of global examples on how to constructively channel assets freed by generation transfer towards future generations and public social capital. England, for example, has a very effective way to boost angel investment and entrepreneurship by making these investments exempt of normal inheritance rules.

I always enjoy what Jesper writes. Very intelligent, well reasoned, and most importantly, makes sense. Going to Japan recently made me observe this country and economy I’ve known my whole life in a different way. As usual, bravo!

Thank you for sharing this bold vision, which is completely aligned with the name of your Substack! It sounds logical to me. In the meantime, the tax authority could increase the annual gift tax exemption limit of only 1.1 million JPY--especially considering the recent devaluation of the value of the yen. Agree?