Japan Reality Check #7: What has changed?

From cool & spoiled kid on the block to mature & reliable performer - Japan Inc. today looks nothing like it did during peak Japan 1989

A friend who has persevered in Japan and now sits in a top position at one of Japan’s financial giants is always ready to quote his university professor when engaging with Japan-hungry global investors: “The more Japan changes, the more she stays the same.”

I haven no doubt about the wisdom of these words; yet at the same time I have learned the hard way to never underestimate Japan’s capacity for radical and dramatic change. It just takes a while. Yes, the culture is proud, dominant, and resilient; but the economic and financial structure has changed fundamentally over the the past generation. In fact, I doubt we can find another financial economy where corporate ownership and corporate performance has evolved as dramatically as it has in Japan over the past thirty years. Japan may seem to abhor change, but certainly embraces progress.

Let’s be specific: Now that the stock market is finally back up to within 20% or so of its all time peak reached at the end of 1989, a ‘compare and contrast’ of some of the key aspects of Japan’s financial economy helps clarify.

What has changed between then and now?

Five standouts:

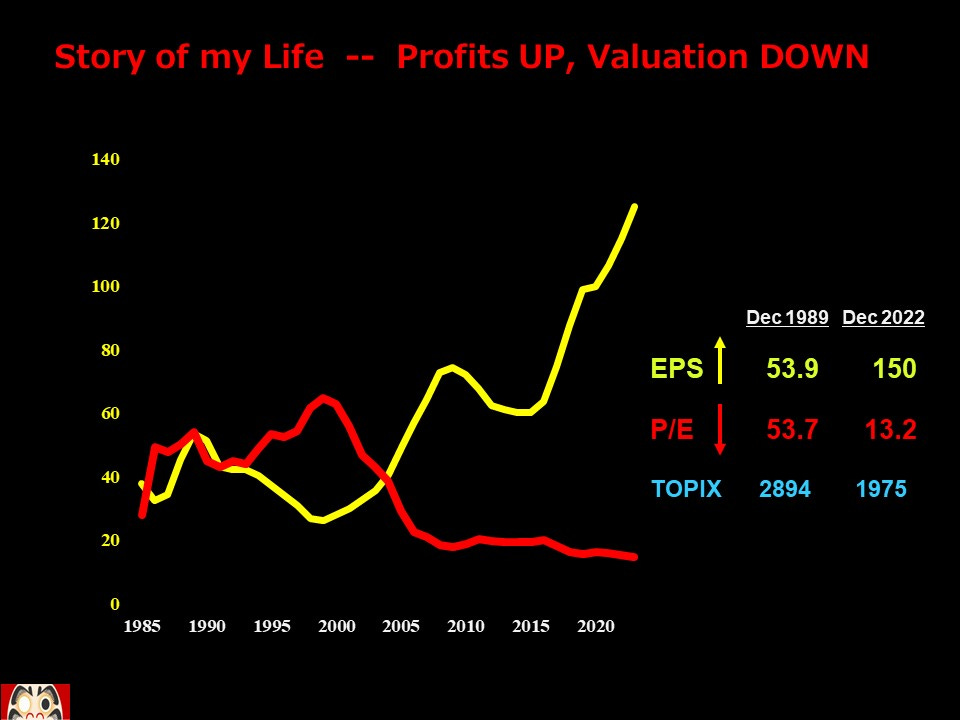

Valuations are way down, but both earnings and capital returns are up a lot. In 1989, TOPIX companies produced Y54 worth of Earnings per share (EPS) and the market traded on a Price-Earning (PE) multiple of 54-times. Today, EPS is basically three-times higher at Y154, but the PE multiple is down almost four-times at 14-times. Return on equity (RoE) was 1.9% and now is 8.5%.

It’s the story of my life here in Tokyo over the past 30-years: corporate economic performance has improved dramatically, but the market pays no premium to hard-earned success. The world wants the dreams of the cool & spoiled kid more so than the pragmatism of the mature craftsman. (see “In praise of the Salaryman CEO” here )

Ownership has completely changed, with the previously dominant insider network of domestic cross shareholdings replaced by the now dominant global ownership and public ownership: cross holding fell from approx. 50% of market cap to 5%; foreign ownership surged from 5% to 33%; and BoJ and the public pension scheme, GPIF, combined ownership rose from 2% to 16%. Oh, and ownership by domestic retail investors -direct and via funds- is basically the same at around 24%.

All said: approximately two-thirds of the cross-holdings unwind has been absorbed by foreigners, and approximately one-third by ‘financial socialism’.

The full reality of Japan’s ‘financial socialism’ is reflected in fixed income markets, with the 10-year JGB yield now at 0.4% compared to the 5.6% recorded end-1989 (it climbed to over 8% by September 1990). The Bank of Japan now owns more than 50% of all government bonds compared to barely 5% in 1989 - and total bonds issued are up more than five-fold….

What is the same? Yes, both consumer price inflation (3.5%) and the currency (Y144/$) are today basically where they were end-1989.

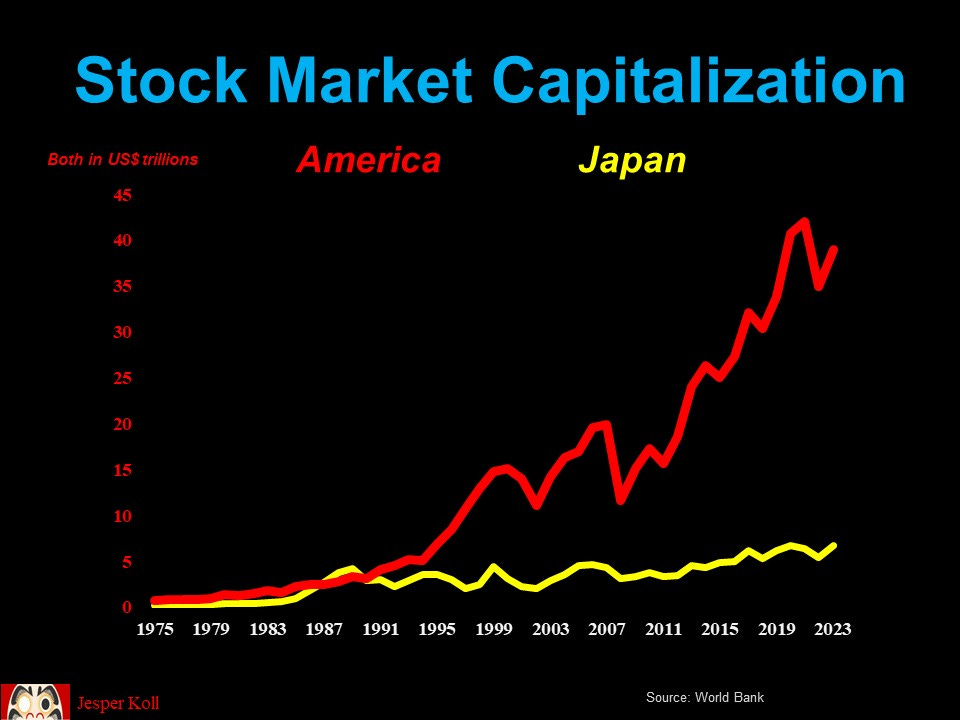

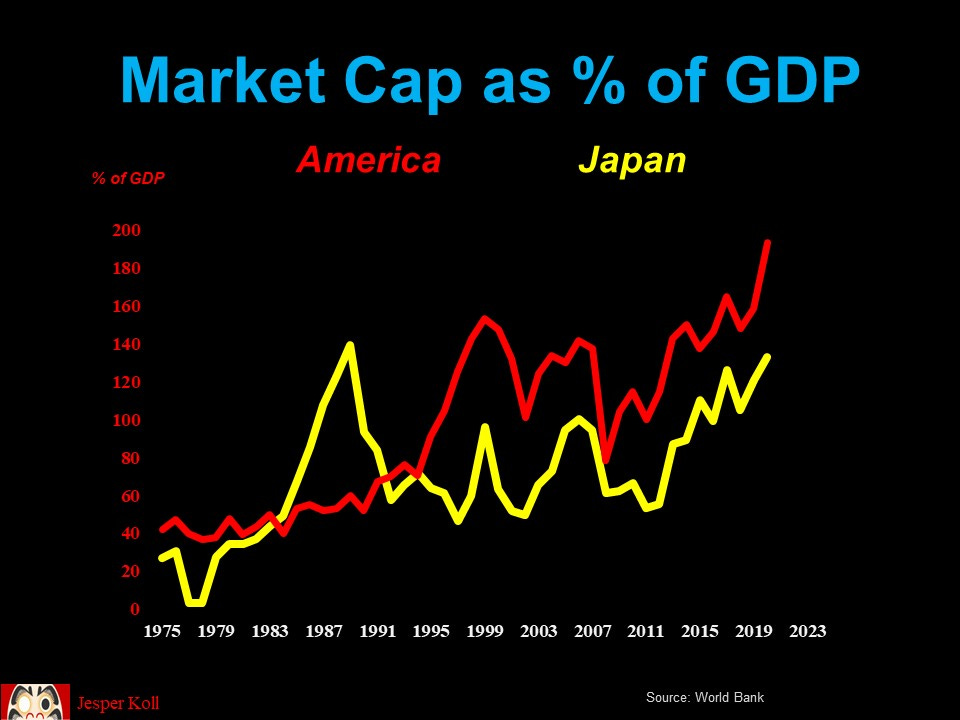

And last but not least, the contrast to America could not be more dramatic: in 1989, Japan’s stock market capitalization was actually higher than that of America both in absolute terms - just above $4 trillion - and relative to GDP, approximately 150% for Japan compared to just below 60% for America.

That was then. Today America’s market cap is up more than 10-fold since, to over $40 trillion; and up around 2-times GDP. Japan’s market cap is up about 20% in absolute terms since 1989; and back up at around 130% of GDP.

Implications and way forward

For financial markets, the primary question is whether (or when…) the newfound corporate investment cycle can actually lift the future growth potential of Japan, i.e. whether the PE-multiple will begin to rise in anticipation of future earnings being deemed too conservative. Here, Toyota is poised to be a litmus test: can the promises of a new revolutionary battery technology off-set the negative drag on expectations forced by the current reality of aggressive competitors growing market share fast?

The second question is whether (or when…) will local asset owners -individuals or pensions- begin to raise asset allocation to the domestic equity market. So far, there is only scant-at-best evidence of this - global investors have been the one and only consistent buyers over the past six-to-nine months. See also “We’re all bullish Japan now” here

At this point, I think it is more likely that global ownership of Japan equities rises from 33% towards 40% rather than domestic retail investors raising their stake from the current 24%. Yes, the new NISA individual stock savings accounts will help marginal inflows from the younger generation; but for real flows to materialize we would need to see changes in the inheritance- and gift tax codes - approximately 70% of all net financial assets are held by people over the age of 65. Already the fear of PM Kishida raising taxes before long is dampening local investor enthusiasm for raising risk asset allocations.

Against this, univocally good news comes from the ownership changes. Increased global ownership almost certainly means continued shareholder ‘activist’ pressure. Japan’s ‘lazy balance sheets’ are poised to be re-deployed towards both new productive capital investments as well as greater rewards for shareholders via higher dividends and share buybacks. Importantly both the GPIF and, to a lesser extend, the BoJ remain at the vanguard and are strong advocates for better governance and higher shareholder returns. Japan-style financial socialism has a smart element of capitalism in it…

And yes, both Team Kishida and Team Ueda remain committed to maintain the current inflationary policy settings…see also “No bubble, no trouble” here

Thank you for reading. As always, comments welcome. Today from hot&sticky Kyoto - thank you & many cheers ;-j

Great post Jesper. One other difference between 1989 and today is that capital gains were still untaxed back in the day. As you will recall, there were stock brokers on every street corner and EVERYONE was busy trading shares. Japan's "stock culture" was at its peak back then. It was lost over the next 30 years but seems to be making a comeback. Thanks again for your insights.

Why use data from June '22, instead of this year's?