We're all bullish Japan now...

Global stand-out: Japan's policy elite remains full-on committed to promote growth and asset inflation

I have been traveling outside Japan for the past four weeks, so apologies for the long silence…. just as I return Japanese equities begin to break-out on the upside and Japan is on the global media front pages not just because of the Hiroshima G7 Summit but because of its strong stock market performance. So by popular request, here is an executive summary of the Japan macro investment strategy presentations I have been giving while away. And yes, I remain steadfast in my bullishness, but new domestic- and global risks bear watching.

The outlook for Yen risk assets - public & private equity & real estate - remains positive. In fact, I expect further acceleration of the recent positive momentum.

Why?

Global standout

At the macro level Japan now stands out as the only major economy with an unambiguous positive policy setting for investors on all fronts:

Japanese monetary policy remains inflationary

Japan is now the only G7 economy with significantly negative real interest rates - the Bank of Japan is committed to maintaining the zero-rate policy anchor, while inflation is now running at more than 3%.

Most importantly, the new BoJ Governor has put his reputation on the line by using every public speech occasion to stress that he and his board are not convinced deflation is over.

After last Friday’s significantly higher-than-expected inflation report he went out of his way to assert that it is too early to consider abandoning large-scale quantitative easing and yield curve control. “Uncertainties are extremely high for economies and financial markets….and the cost of making pre-mature policy adjustments is extremely large, and bigger than that of waiting”.

Japanese fiscal policy remains inflationary

Prime Minister Kishida has just passed yet another extra fiscal boost commitment. This time the boost is focused on raising child- and income support for households.

Importantly: unlike the U.S. or Europe, Japan’s fiscal initiatives do actually get turned into law - Kishida’s LDP holds a supermajority in parliament and his track record of turning expenditure policy proposals into law is 100%.

And no, Japan does not have a debt ceiling law or Maastricht-rules that constrain fiscal action. This year’s public sector borrowing requirement --JGB issuance — is now on track to possibly exceed last year’s, estimated at just above 6% of GDP.

Japanese financial regulatory policy remains pro-shareholder value

Japanese regulators and policy makers remain dead-set focused on promoting shareholder value. This is in sharp contrast to developments in both the U.S. and Europe where ruling parties tax policy proposals now regularly include proposals to raise capital gains taxes as well as levies on share-buybacks.

Against this, Japan’s policy elite keeps on becoming more pro-active on promoting capital efficiency and shareholder returns.

Specifically: effective April 1, the Tokyo Stock Exchange has put into force guidelines that threaten serious consequences - including potential relegation from the main board to minor boards - for CEOs who cannot present pro-active corporate action to boost the book-value of their companies if their companies shares have been trading at below 1-times book value for several years.

Clear speak: activism is going mainstream in Japan. This new TSE initiative raises significantly the probability that Japanese equities will escape from the value-trap, in my view. Watch for domestic institutional investors to put more pressure on management to generate returns and shareholder value in the upcoming general shareholders meetings this in June/July.

Currently, just about half of Japan’s listed companies trade below book…

Japanese tax policy creates concrete incentive for greater equity allocation for retail investors

Effective this year, PM Kishida more than doubled the amount Japanese households can invest in equities, free of capital gains tax and dividend tax.

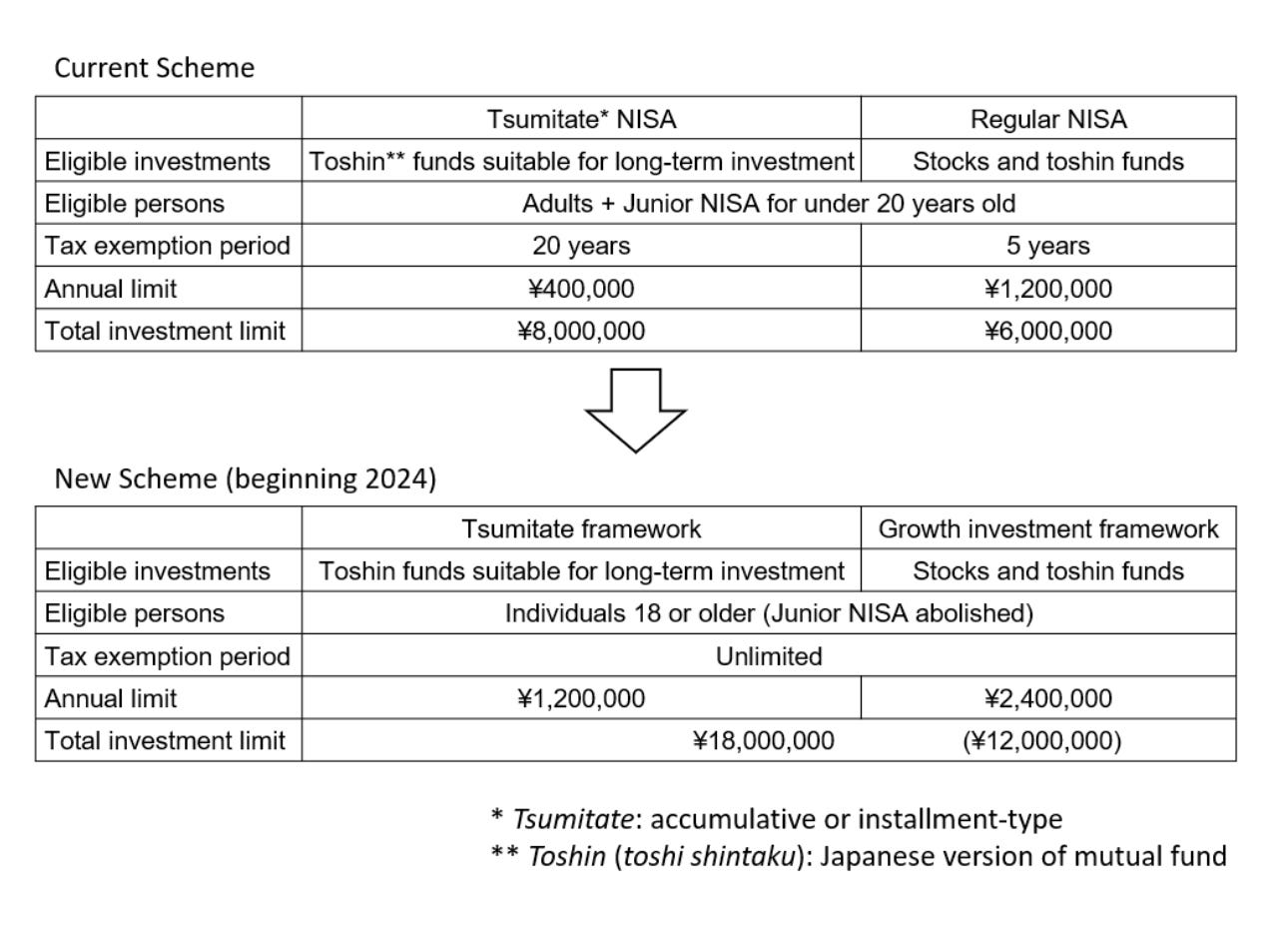

The numbers are significant: this new expanded NISA - effective from next year - raises the tax-exempt period from the current maximum of 20-years to unlimited, i.e. your lifetime; and the total investment limit will go up from the current maximum of Y8 million to Y18 million. Given that median household net financial assets stand at around Y18 million, the authorities now tax incentivize households to all of their savings in “risk assets”. Clearly, this is excellent news for retail investors. Prime Minister Kishida may well have found the catalyst that triggers the long-overdue asset allocation shift in household sector assets.

5.) Japanese corporations are finally beginning to invest in both human- and productive capital

For the past twenty years, corporate investment in both labor and capital has been stagnant. The focus was very much on cutting costs and, if at all, investment in productive assets was focused on overseas expansion; and investment in human capital was focused on part-time and contract employment. (see this on how Japan is underinvested and overcapitalized).

This has changed. Business investment keeps being the primary source of positive growth surprises, with both industrial and service sector companies now committed to upgrade domestic factories, local logistics hubs, tech-infrastructure etc.

And yes, on-shoring / friend-shoring driven by the new geo-political realities is real and helping to add further momentum. Over the past twelve months, commitments to build new high-tech factories in general, semi-conductor ones in particular add to almost 1% of GDP of new capital spending over the next two years.

Moreover, investment in labor has also turned positive - wages are rising and employment contracts are improving with an increasing number of full-time jobs being created. (see the Demographic Sweetspot article)

Japan’s corporate metabolism is going up

In addition to the pick-up in investment in labor and productive capital, the overall corporate metabolism is also rising. Venture Capital has been committing record new investments into Japan-based start-ups; domestic M&As are surging, as are Management Buyouts. see this on Japan Venture Capital

All said, the ability and willingness of Japan’s private sector -households and corporations- to take risks is going up, and public policy remains steadfast in its commitment to promote it; and -in contrast to fellow G7 leaders- PM Kishida and BoJ Governor Ueda are more worried about tightening pre-maturely than about needing to be conservative.

Clear-speak: after more than thirty years, a positive break-out above the historic “Bubble Peak” of 40,000 on the NIKKEI stock index is finally becoming a realistic prospect over the next 15-18 months.

What can go wrong?

The principal forces that could derail the structural bull-case for Japan are the following - two domestic ones, and two global ones:

Governor Ueda is wrong on inflation

The stronger Governor Ueda insists on the potential downside risks to inflation, the bigger the negative shock for markets will be if he is wrong and the visibility of inflation continues to rise. Will Governor Ueda be forced to hike rates faster than anticipated in a rush to save his reputation?

Here, the risks are rising, in my view, as evidence of demand-pull inflation and a shift towards genuine corporate price-power is increasing. Watch for a further acceleration in service-sector CPI inflation, as well as a strong summer bonus season for potential trip-wires.

Prime Minister Kishida calls for tax hikes

Calls for tax hikes to finance PM Kishida’s spending spree keep getting louder. This could crescendo this autumn, when the Government Tax Council will make their proposals on how to fund next year’s budget.

In my view, the risk of tax hikes coming next year goes up, in my view, if Prime Minister Kishida calls an early election now that his popularity has risen smartly after the “gift” to households with children and his leadership during the Hiroshima G7 summit.

Be this as it may: by October/November the elite technocrats are poised to step-up their campaign for supposedly much needed tax hikes. It is a better than even bet that Prime Minister Kishida will give in, even if he does not get the election out of the way.

China currency devaluation

Japan and China are direct global competitors, with almost two-thirds of their respective export industries in head-on competition in global markets. Now that US industrial and economic security priorities are shutting down China’s ability to compete globally, the threat of excess capacity and rising unemployment for China’s industrial companies could become real. If this slack does not get absorbed by China successfully opening new markets, pressure for a currency devaluation is poised to rise. A China currency devaluation would force a direct negative impact of Japan’s global competitiveness, particularly in non-U.S. markets.

I realize these are a lot of “ifs”; but I do worry that the new global realities will sooner or later lead to radical global currency adjustments that leave the Yen exposed to relative appreciation and margin squeezes for Japan’s global corporates. More on that in a forthcoming paper.

An about-turn by the Federal Reserve

Of course, the biggest global threat would be a radical about-turn in U.S. monetary policy. As U.S. recession risks rise, both global and Japanese investor are poised to become first of all more risk averse, i.e. cut global equity allocations and raise cash; and then begin to deploy that cash in the market traditionally most likely to benefit from the Federal Reserve cutting interest rates, i.e. Wall Street more so than Tokyo.

Thank you for reading. As always, comments welcome. And I look forward to seeing many of you in Tokyo soon. Many cheers ;-j

Not sure I understood this, but it seems completely wrong.

"Japanese tax policy creates concrete incentive for greater equity allocation for retail investors

Effective this year, PM Kishida doubled the amount Japanese households can invest in equities, free of capital gains tax and dividend tax.

The numbers are significant: this new expanded NISA raises the tax-exempt period from 5-years to 20-years, and the total investment limit from Y6 million to Y8 million. Given that median household net financial assets stand at around Y18 million, the authorities now tax incentivize households to hold around 40% in “risk assets”."

Are you referring to the New NISA, starting next year? If so, the tax-exempt period (which is currently 5 or 20 years depending on NISA type) becomes unlimited, the annual contribution limit rises to 3.6m, and the lifetime contribution limit rises to 18m yen. This is a great development for individual investors in Japan.

Always a pleasure to read your work, thank you for the detailed analysis. Cheers